2025 Delinquent Tax List

UPDATED LIST 2-26-2025

BUFFALO COUNTY PUBLIC SALE DATE – MARCH 3, 2025

Buffalo County Courthouse

1512 Central Ave, Kearney, NE 68847

9:00 a.m.

Check in will be from 8:00 to 8:45 at the Buffalo County Treasurer’s Office

EVERYONE AT THE SALE MUST WORK FROM THIS UPDATED LIST.

WE WILL NOT ADJUST THE SPEED OF THE SALE TO ACCOMMODATE THE USE OF OTHER LISTS.

REGISTRATION

Pre-Registration is strongly advised.

Registration for the sale will begin the Monday before the sale. In order to register and participate in the Buffalo County Tax Sale, you will need to provide the following:

- Completed Buffalo County Tax Sale Registration Form.

- W-9

- $25.00 Registration Fee for each bidder - nonrefundable.

- Blank Check for the purchase of certificates.

- Nebraska Statute (77-1807) requires every entity or person to pay a non-refundable registration fee of $25.00 prior to the sale in order to participate. The fee is not refundable upon redemption.

There is a limit of 25 bid numbers per company/individual.

- We will allow companies/individuals to purchase multiple bid numbers, but request only one person attend the sale regardless of bid numbers purchased. We can advise you how to make this work.

- Thursday morning before the sale, random bid numbers will be drawn for those who are registered. Your bid numbers will be supplied to you after the drawing, or, to your representative at check-in the morning of the sale.

CHECK-IN

Check in will be from 8:00 to 8:45 at the Buffalo County Treasurer’s Office.

Buyers and all buyer’s representatives must check in at the Treasurer’s Office and have all paperwork completed before they will be allowed into the sale.

If you have questions, please contact our office at 308-236-1254.

2025 Bidder registration form

Bidder Instruction Sheet

W-9 Form

Flock Safety System

Automatic License Plate Readers (ALPR) have long helped law enforcement in solving crimes. ALPRs capture computer-readable images of license plates, allowing law enforcement agencies to compare plate numbers against those of stolen cars or cars driven by people suspected of being involved in criminal activities.

The information by ALPR cameras can help determine whether a vehicle was at the scene of a crime and to discover vehicles that may be associated with each other. Law enforcement agencies can choose to share their information with other agencies. The cameras can also integrate information from national or state crime databases to provide real-time alerts when a vehicle associated with a known suspect or a stolen vehicle passes the camera.

According to the National Conference of State Legislatures, when employed ethically and objectively, ALPRs are an effective force-multiplying tool for law enforcement. A 2011 study by the Police Executive Research Forum concluded that ALPRs used by Mesa, Ariz., Police resulted in “nearly 3 times as many ‘hits’ for stolen vehicles, and twice as many vehicle recoveries.”

Flock Safety communities have reported overall crime reductions of over 70 percent after a period of time utilizing the ALPR system. In some areas, that included an over 60 percent reduction in non-residential burglaries, 80 percent reduction in residential burglary, and an over 40 percent reduction in robberies.

What is Flock Safety?

Flock Safety is a public safety operating system that helps communities and law enforcement work together to eliminate crime, protect privacy, and mitigate bias. We build devices that capture objective evidence and use machine learning to detect and deliver unbiased investigative leads to law enforcement. Flock Safety communities have reported crime reductions of up to 70 percent.

Today, there are over 1,500 Flock Safety communities; we partner with 1200+ law enforcement agencies. The Buffalo County Sheriff’s Office has partnered with the Kearney Police Department under their MOU with the FLOCK Safety System.

Kearney Police Department Flock Transparency Portal

Buffalo County Sheriff’s Office Automated License Plate Reader (ALPR #1346)

Nebraska Revised Statutes – Automatic License Plate Reader Privacy Act 60-3201 to 60-3209

Flock ALPR Data Year End Report

Vigilant Mobile ALPR Year End Report

Off Duty Management

In order to efficiently respond to

requests and manage the employment of off-duty police officers, The Kearney Police

Department has partnered with Off Duty Management to provide services related

to hiring off-duty officers effective September 27,2021.

You may request to

hire off-duty police officers through the Off Duty Management web-based

service, OfficerTRAK®, or calling the number below.

Off Duty Management provides the following to the vendor:

- Online access to information through the OfficerTRAK® software including:

- Job-status

- Officer attendance

- Field notes and media files

- Post orders and instructions

- Past and future shift information

- Full liability coverage for the vendor, the agency, and the officer

- 24/7 vendor service

- Dedicated point of contact for scheduling and invoicing

- Officer payroll

Prohibited Off-Duty Employment*:

- Private detective agencies

- Licensed liquor establishments

- Sell, manufacture, or transport alcoholic beverages

- Collection agencies

- Advertising agencies (use of uniform or office to endorse products or businesses);

- Process server

- Bail bond agency

- Repossessing property or evicting persons or entities from premises

- Assisting in case preparation or investigation for any criminal defense or civil proceedings

- Employment as an investigator or in any capacity involving the use of police records for other than law enforcement purposes

- Employment that would be likely to bring the Police Department or the officer into disrespect, disfavor or ridicule, or involve the officer in a violation of Department policies, procedures or rules

- Other situations, locations or capacities not approved by the Chief of Police.

- Cannot access, use, or convey any data, files or information that is proprietary, is under the control of, or was collected and stored by this or any other law enforcement agency.

- Cannot perform any task or job that would bring discredit or embarrassment to the Kearney Police Department.

*PLEASE

NOTE: the above

list is not an all-inclusive and questions regarding permitted activity should

be forwarded to Off Duty Management.

RATES:

2 Hours minimum per request.

|

Regular

|

$57.50 |

|

Supervisor*

|

$69.00

|

|

Holiday**

|

$69.00 |

|

Emergency***

|

$63.25 |

| Vehicle |

$28.75/HR. $115 Daily M |

| State Sales

Tax 7% for all Security Posts/ No Tax for Traffic Jobs |

*Supervisor Rates: A supervisor is required when four or more

officers are requested.

**Holiday Rates: Rate will apply to the following days: New

Year’s Day, MLK Day, Presidents’ Day, Memorial Day, Juneteenth, Independence

Day, Labor Day, Thanksgiving Day, Day After Thanksgiving, Christmas Eve,

Christmas Day.

***Emergency

Rates: If request is received less than

72 hours prior to assignment the emergency pay rate goes into effect.

Cancellation policy:

Once an assignment has been approved and scheduled; vendors

canceling or reducing assignments are required to pay the full ODM

administrative fees for the first 24 hours of the original assignment. Vendors

canceling or reducing assignments within 48 hours of the start of the

assignment are required to pay the greater of officer hours worked or the

agency minimum hours plus ODM administrative fees for the first 24 hours of the

original assignment.

YOU CAN REQUEST SERVICE BY VISITING THE OFFICERTRAK® WEBSITE

OR CALL OFF DUTY MANAGEMENT 24/7 (308) 281-1827

Notice of "RECORDED DEED NOTICE" Scam

The Scam Address and Phone Number have changed. The Amount now shows $86.00—it was $83.00 during their last attempts 4 years ago.

The Register of Deed Office is a public office and a copy of their Deed can be acquired during regular business hours for $.50 a page.

This is a SCAM--- DO NOT SEND MONEY TO THIS COMPANY!! IF YOU NEED OR WANT A COPY, please come the Register of Deeds Office at the courthouse and we can provide you a copy for $.50 a page.

For any questions please contact Kellie John, Buffalo County Register of Deeds at (308)-236-1239.

A detailed look at this scam and the 2015 Kearney Hub article

Assessor Calendar

| |

|

| Jan 01 |

Assessment of Real Property (Discovery, List, Value) 77-1301

|

| Jan 01 |

Assessment of Personal Property (Discovery, List, Value) 77-1201 |

| Jan 01 |

R R & Pub Serv req’d Report Non-Operating

Property to Assessor. 77-606 & 77-801 & Calendar

for Railroads & Public Service Entities. |

| Jan 01 |

Effective Date for Filing: Homestead Exemption Claimants MUST be (a) Owner of Record and (b) Occupy the homestead. (c) MUST be 65 or older.(d) Effective Date of Disability and Filing Status. 77-3502 77-3505 |

| Jan 15 |

Mobile Home Court Owner et al files Report w Assessor 77-3706 |

| Jan 31 |

Gov’l Subdivisions provide Assr Off w COPIES OF LEASES or descriptions of Leased property. 77-202.11

|

| Jan 31 |

Deadline for county Board of Equalization to petition the Tax Equalization & Review Commission for use of a different approach to value rent-restricted housing projects. (LB 356) 77-1333

|

| Feb 01 |

Assessor makes recommendations on permissive exemption applications Form 451. To Board of Equalization. Notice must be published in the paper, ten days prior to consideration of applications by the B O E that a list of organizations seeking permissive exemptions, legal descriptions, and Assessor

recommendations is available in the Assessor’s Office. 77-202.01 |

| Feb 01 |

Statements of Reaffirmation Form 451A do not need to be approved by the BOE only by Assessor. 77-202.01

|

| Feb 01 |

Assr issues notice of approval / denial Beginning Farmer Exemption Form 1027 77-5209.02 |

| Feb 01 |

Aircraft Report filed with Assessor. 77-1250.02

|

| Feb 01 |

Last day P.T.A. provide counties w Printed Claim Forms and Address Lists of prior year applicants. 77-3510

|

| Feb 01 |

First day for claimants to file NE Homestead Exemption App or Certification of Status. May fall on Feb 2 or 3 if Feb 1 is on Sat or Sun. 77-3512, 77-3513, 77-3514 |

| Feb 28 |

Seeking Separate Taxation of IOLL &

LAND File Form 402 Improvements on Leased Land Assessment Application 77-1376

|

| Mar 01 |

Certify to P.T.A whether or not Ag & Hort Land are influenced by prices outside of the typical ag-hort land market. REG 17-003.03

If Special Valuation is used, must file specific information w P.T.A.. REG 11-005.04

|

| Mar 01 |

Improvements owner on LEASED PUBLIC LAND may file Form 402P Improvements on Leased Public Land Assessment Application 77-1374

|

| Mar 01 |

ASSR notifies governmental subdivisions of intent to tax property not used for public purpose

and not paying an in lieu tax. 77-202.12

|

| Mar 01 |

PTA submits report of active TIF to the legislature see Research Reports on web site. 18-2117.01

|

| Mar 16 |

Deadline for written request for

Extension of Time from PTA to file the County

Abstract of Assessment

for Real Property (Form 45) and the AVU

Directive 09-1 & 77-1514

|

| Mar 19 |

Must inspect-review portion of real property parcels in county so that all real property parcels are

inspected-reviewed no less than every 6 years. March 19, 2014 completes first 6-Year cycle 77-1311.03

|

| Mar 19 |

Complete the County Abstract of Assessment for Real Property (Form 45) with the PTA (and the Assessed Value Update (AVU)) 77-1301

|

| Mar 19 |

Certify the County Abstract of Assessment for Real Property (Form 45) with the PTA (and the Assessed Value Update (AVU)) 77-1514

|

| Aft Mar 19 |

Overvaluation or Undervaluation. After March 19 and before July 25 (Aug 10 when extension) report to B.O.E. any overvalued or undervalued property. 77-1315.01

|

| Anytime |

Duty to report to BOE all real property omitted from the assessment roll for the current or any former year except when such real property has changed ownership otherwise than by will,

inheritance, or gift. 77-1317, 77-123, 77-124,

|

| Anytime |

Correct the tax rolls as provided in section 77-1613.02 for any real property listed on the Assessment roll but omitted from the tax

roll. 77-1316.01

|

| Anytime |

BOE may meet at any time for correction of clerical errors defined in 77-128. 77-1507 (Clerical error means transposition of numbers, mathematical error, computer malfunction causing programming and printing errors, data entry error, items of real property other than

land identified on the wrong parcel, incorrect ownership, or certification of an incorrect valuation

to political subdivisions.) 77-128

|

| Mar 25 |

Assessorr may submit written comments to P.T.A. that become part of R & O REG 17-003.04

|

| Apr 01 |

If homestead exemption notices mailed on or before Feb 01 did not contain all of The statutorily required information a 2nd notice must be sent on/before April 01. 77-3513, 77-3514

|

Apr 01

|

If homestead exemption notices mailed on or before February 1 did not contain all of The statutorily required information, a 2nd notice must be sent on or before April 1 77-3513 77-3514

|

Apr 01

|

Last day to send a RE-APPLY reminder to eligible previous year homestead Exemption

applicants. 77-3513, 77-3514

|

| May 01 |

First-1/2 Real & Personal Property Taxes for Prior Year become delinquent 77-204

|

| May 01 |

Deadline File Ne Personal Property Return & Schedule w/o penalty. 77-1229

|

| May 01 |

Deadline w Agreement, File Form 775P &/or Form 312P Claim for P P Exemption & supporting schedules 77-4105 (2)(c ) & 77-5725 (7)(c)

|

May 01

|

First ½ of real & personal property taxes for prior assessment year become delinquent If unpaid in counties with less than 100,000 population. 77-204

|

| May 01 |

Deadline Physician’s Certificate for LATE

Homestead Exemption filing FORM 458L In counties less than 100,000 population. 77-3512, 77-3513, 77-3514.01

|

| May 15 |

Last Day for T.E.R.C. to adjust the valuation

of a class/sub-class of real property. 77-5028

|

| May 30 |

Deadline TREA & ASSR file FORM 458X

amended homestead exemption summary Certificate for tax loss previous year (NOTE: 458X may be filed reflecting changes based on income ANYTIME up to 3 years after the exemption year.) 77-3523 and 77-3517

|

| May 31 |

School system of County Official may request

corrections to school adjusted valuation due to tax list corrections of the prior assessment year. 79-1016

|

| Jun 01 |

Assr publishes a notice in the newspaper CERTIFYING the (a) assessment roll is Complete, (b) notices of valuation changes have been mailed, and (c) stating the final date for filing protests with the B O E 77-1315

|

| Jun 01 |

Freeholder files petition with local board (Assessor, Treasurer & Clerk) to have school districts changed which is contiguous to that land. 79-458(1)

|

| Jun 1 - Jul25 |

B O E holds hearings to review property valuation PROTESTS 77-1502

|

| Jun 5

|

If T.E.R.C. ordered changes, Assessor re-Certifies the Abstract with PTA 77-5029

|

| Jun 6 |

Assr mails assessment sales ratio stats given

by TERC to media & posts in office. 77-1315

|

| Jun 15 |

Assr prepares a PLAN OF ASSESSMENT report for the next 3 years. 77-1311.02

|

| Jun 30 |

Deadline for filing Homestead Exemption App

or Certification Of Status, Form 458 77-3512

|

Jun 30

|

Deadline Late Application and Written Request B O E for Waiver of Late Filing for permissive

exemptions Forms 451 or 451A 77-202.01

|

| Jun 30 |

Deadline. SPECIAL VALUATION application Ag-Hort use. Form 456 77-1345

|

Jun 30

|

Deadline file property valuation protest with

County Clerk (for BOE) 77-1502

|

Jun 30

|

Deadline P P Valuation Protest Returns filed

Jan 1 thru May 1 with County Clerk 77-1502

|

Jun 30

|

Deadline. SPECIAL VALUATION application Ag-Hort use. Form 456 77-1345

|

| Jun 30 |

Last day to add Personal Property value with a 10% Penalty 77-1233.04

|

| Jul 01 |

Added Personal Property is subject to 25%

Penalty from this date forward. 77-1233.04

|

| Jul 15 |

ASSR approves-denies SPECIAL VALUATION apps; notifies applicant before July 22 77-1345.01

|

| Jul 20 |

If deadline extension granted by B O E, new

Deadline for filing Homestead Exemption App or Certification Of Status, Form 458 77-3512

|

| Jul 20 |

County Assr electronically certifies the County Personal Property Abstract Report to the P.T.A. (beginning 2016) (LB 259) 77-1514

|

| Jul 22 |

Assr notifies applicants of special

valuation of approval or disapproval 77-1345.01

|

Jul 22

|

BOE sends notice of value change on Special Valued land if no notice previously Sent by Assr prior to June 1.

|

| Jul 26 |

BOE petition T.E.R.C. for an adjustment to the valuation of a class/sub-class of property. (NOTE: If protest period extended, BOE waives right to petition.) 77-1504.01; 77-1502

|

| Jul26-Aug24

|

Taxpayer file appeal of BOE to T.E.R.C. 77-1510

(NOTE: may file appeal to T.E.R.C. on/before Sep 10 for extended counties)

|

| Jul 31 |

Last day ASSR send Notice of Rejection of Homestead Exemption Form 458R 77-3516

|

Jul 31

|

Assr files 3-Year Plan Of Assessment with the BOE 77-1311.02

|

Jul 31

|

Last day for Annexations Pol Subs for taxable value in current year. 13-509(NOTE: Annexation by

Pol Subs on/after Aug 1 considered next year

taxable)

|

| Aug 01 |

Last day FORWARD approved Homestead Exemption Application or Certification of Status, Form 458, with Disability Certifications, Form 458B, or Veterans Affairs Letters, and Form 458 Schedule I – Income Statements to Tax Commissioner. 77-3517

|

Aug 01

|

Assr reviews ownership & use of all cemetery real property and reports to BOE. 77-202.10

|

Aug 01

|

Last Day Pol Sub submit request for LEVY ALLOCATION to BOE or CITY. 77-3443

|

Aug 01

|

CITY or Community Redevelopment Authority (CRA) files NOTICE to Divide Tax For Comm Redevel Project (T I F) with the County Assr. 18-2147(3)

|

| Aug 01 |

PTA certifies to T.E.R.C. the ASSR implemented the equalization orders. 77-5029

|

| Aug 01 |

Tax Commissioner certifies Exempt P P for Employment & Investment Growth Act Form

775P and Nebraska Advantage Act Form

312P ; notifies Taxpayer and County Assessor. 77-4105; 77-5725(c)

|

| Aug 02 |

County Clerk mails notice of B O E decisions

to protestors. 77-1502(4)

|

| Aug 10 |

Last Day T.E.R.C. act on BOE petition.. 77-1504.01

|

| Aug 10 |

T.E.R.C. sets equalization rate for real property of Centrally Assessed Railroads and Public Service

Entities. 77-5022

|

| Aug 10 |

PTA certifies distributed taxable value of Centrally Assessed Property to Assessor. 77-5030

|

| Aug 15

|

Approved Freeholder Petition filed on/before June 1 of current year become Effective. 79-458(3)

|

Aug 15

|

ASSR approves/denies Homestead Exemption based on Ownership or Occupancy From Jan 1 through Aug 15 77-3502

|

Aug 15

|

Deadline for Homestead Exemption to file an Application for Transfer Form 458T 77-3509.01

|

| Aug 20

|

Certify taxable valuations & growth value to political subs. Certify current values For each T I F project to City or Community Redevelopment Authority (CRA) and to Treasurer 13-509; 13-518; 18-2148

|

| Aug 20

|

If T.E.R.C. orders changes for B O E petitions, ASSR re-certifies ABSTRACT (Form 45) to PTA 77-1504.01

|

| Aug 24

|

Last day taxpayer appeals B O E decision to T.E.R.C. 77-1510

|

| Aug 25 |

ASSR certifies School District Taxable Value Report to P.T.A.. 79-1016

|

| Aug 31

|

Annual Inventory County Personal Property in custody of Assessor 23-347

|

Sep 01

|

Second-1/2 Real & Personal Property Taxes for Prior Year become delinquent 77-204

|

Sep 01

|

After B O E value adjustments, Assr determines AVERAGE RESIDENTAL VALUE For homestead exemption and certifies the Homestead Exemption Certification of Average Assessed Value of Single-Family Residential Property Form 458V to PTA 77-3506.02

|

Sep 01

|

No LEVY allocation change after this date except by agreement by LEVYING Authority and Political

Subdivision. 77-3443

|

| Sep 10 |

Where B O E extended Protest Hearings, Last day Protestor appeal BOE decision to T.E.R.C 77-1510

|

| Sep 15 |

B O E last day for decision on Under or Over Valued Property 77-1504

|

| Sep 15 |

P.T.A. certifies the amount of Real Property TAX CREDIT to State Treasurer and to each county. 77-4212

|

| Sep 20 |

BUDGETS must be Final and Filed with the levying board and State Auditor. 13-508

|

| Sep 30 |

ASSR may amend the School District Taxable Value Report for corrections or errors 79-1016

|

| Sep 30 |

BOE publishes list of Permissive Exemptions and sends list and proof of publication To P.T.A. 77-202.03 (5)

|

| Oct 1 |

Rent-Restricted Housing Projects file INCOME &

EXPENSE STATEMENTSs and any Other Info requested by Assr with both Assr & Tax Commissioner. (LB 356). 77-1333

|

| Oct 1 |

Rent-Restricted Housing Projects file INCOME &

EXPENSE STATEMENTS and any Other Info requested by Assr with both Assr & Tax Commissioner. (LB 356). 77-1333

|

| Oct 9 |

Last Day for voter approval to exceed LEVY limits or final allocation at election or “town hall meeting.” 77-3444

|

| Oct 10 |

P.T.A. certifies the school adjusted valuations to

Dept of Ed, School systems, and County Assessors. 79-1016

|

| Oct 10 |

P.T.A.certifies the school adjusted valuations to

Dept of Ed, School systems, and County Assessors. 79-1016

|

| Oct 13 |

Political Subs forward resolution setting a tax request different from the prior year to County Clerk 77-1601.02

|

| Oct 15 |

LEVY DATE Last day

B O E to set tax rates/levies 77-1601

|

| Oct 15 |

Last Day taxpayer file B O E appeal to T.E.R.C. re under or over valued property 77-1504

|

| Oct 31 |

Assr submits 3-Year Plan and any Amendments to Dept of Revenue 77-1311.02

|

| Nov |

Rent-Restricted Hsg Projects Valuation Committee meets annually in November to Examine Rent-Restricted Hsg Projects statements & expense reports in order to Calculate a Market-derived Capitalization Rate. (LB 356) 77-1333

|

| Nov 1 |

Last Day Tax Comm certifies qualified Homestead Exemption income determinations to the County

Assessor. 77-3517

|

| Nov 5 |

Last Day B O E correct levies/tax rates as a result

of clerical error. 77-1601

|

| Nov 10 |

Deadline school sys file appeal with Tax Comm

for the School Adjusted Value Certified for use in the school aid formula. 79-1016

|

Nov 10

|

School Dis or County Off deadline file written

request w Tax Comm correction school adjust

value due to clerical error or SPECIAL

VALUATION ADDITIONS 79-1016 |

| Nov 15

|

Deadline. EXEMPT TO EXEMPT. For an org to file a permissive exempt application For property it purchased between July 1 and levy date previously exempt. 77-202.03

|

| Nov 22 |

Deliver Signed WARRANT For Collection Of Taxes To Treasurer having completed the tax list for real and personal property. 77-1616

|

| Nov 30 |

Deadline ASSR & TREA certify to P.T.A. Homestead Exemption Summary Certificate Form

458S for tax loss due to homestead exemptions for the current tax year.(Both signatures required) 77-3523

|

| Nov 30 |

Deadline for ASSR & TREA certify electronically the Personal Property Tax Loss Summary Certificate for personal property exemption for locally assessed property(beginning 2016) (LB 259) 77-1239

|

| Dec 01 |

Assr files Certificate of Taxes Levied (CTL)

with P.T.A. 77-1613.01

|

| Dec 01 |

City or CRA (Community Redevelopment Authority) files report with P.T.A. for approved tax

increment financing projects (T I F) 18-2117.01

|

| Dec 01 |

Last day Property Tax Administrator (P.T.A.)

forwards copy of Rent-Restricted Housing Projects annual report by the Valuation Committee to ASSR for Cap Rate In determining value of rent-restricted

housing projects. (LB 356) 77-1333

|

| Dec 01 |

Deadline for ASSR to ensure sales data in state sales file is accurate and all sales Are included. Directive 12-05 |

| Dec 31 |

Real Property & Personal Property Taxes Due – LIEN DATE 77-203

|

| Dec 31 |

Permissive Exemption Application deadline For newly acquired property or in years divisible by four, file Exemption Application Form 451

For interim years, file Exemption Application Form 451A

For example: File Form 451A by Dec 31, 2014 to

reaffirm for assesssmt year 2015 File Form 451 by Dec 31, 2015 to apply for assessmt year 2016 (which is divisible by 4) 77-202.01; 77-202.03

|

| Dec 31 |

Deadline. Form 1027 Exemption App Qual Beginning Farmer / Livestock Producer Must be filed with Assr on-before Dec 31 in the year preceeding year applied for.Exemption is for

Personal Property tax on ag-hort machinery & equipment. 77-202.01; 77-5208; 77-5209.02

|

Dec 31

|

Deadline for taxpayer/owner to file Vacant or

Unimproved Lot Application, Form 191To elect to have 2 or more lots held for sale/resale to be treated as one parcel for Property tax purposes. 77-132

|

Dec 31

|

Owner petition T.E.R.C. determine taxable status of real property – if a failure to give proper notice prevented the timely filing of a protest or appeal for exempt property.

|

Dec 31

|

Last Day for Tax Commissioner to review income and other information for the third Preceding year and take any action. 77-3517

|

| May 01 & Sept 01 |

First 1 / 2 and 2nd 1 / 2, Real and Personal Property Taxes for prior assessment year Sept 01 become delinquent, if unpaid, in counties with a population less than 100,000 pop’n. 77-204

|

Register of Deeds Records Online Information

Search County Land Records 24 Hours a Day!

Laredo

Designed for users who consistently search in a single county

Fidlar Software has designed Laredo, a remote access product, with your objectives in mind. Laredo’s innovative technology and 24-hour access to the county’s land records allows you to obtain information faster and more efficiently.

Benefits

- Same user interface that is used on the courthouse workstation

- Real time, 24/7 access

- Customizable results screens

- Subscription based

Cost Breakdown:

Per-minute Plan Charges

| Minutes |

Price/Month |

Overage Charge/Minute |

| 0-250 |

$75 |

$0.25 |

| 251-500 |

$125 |

$0.20 |

| 501-1000 |

$200 |

$0.15 |

| 1001-2000 |

$300 |

$0.10 |

| Unlimited |

$450 |

|

**Per minute charge for each minute over the signed-up plan

To Sign Up:

To become a Laredo Subscriber please contact the Buffalo County Register of Deeds Office @ 308-236-1239.

To Search:

Once you have signed up, and have been issued a username and password, go to the Fidlar website select Nebraska as the state, then Buffalo as the county, and click download.

Tapestry

Designed for the occasional users or those who want the freedom to search in all Fidlar counties

All you need is a web browser for 24/7 access to county land records. From the Tapestry web site, users can access information from ALL participating counties. Tapestry allows for both pay-as-you-go access, and an open account payment plan.

Benefits

- 24/7 Remote Internet access

- Secure browser based access

- Search via many data parameters (grantor/grantee, date range, document number, legal description, etc.)

Tapestry Cost Breakdown

- Index/Image Search - $8.75 per search

- Grantor/Grantee

- Beginning/Ending Date

- Consideration amount

- Legal description - Subdivision, parcel ID, Metes & Bounds

- Document search types

- Print copies - $1.00 per page

- Viewing images is included in the per search fee

Flexible Payment Options:

- Pay-as-you-go with a credit card - Visa & MasterCard accepted

- Open Account Payment Plan - $25 minimum per month

Juvenile Justice System Guide

“The only real mistake is the one from which we learn nothing.”

--John Powell

REASONS FOR BEING IN COURT

Delinquent: charged with breaking a law of a State or City Ordinance.

Status Offender: Charged with being beyond control of his/her parent(s) or habitually truant. Examples include not going to school, not keeping a curfew, running away from home, not obeying parent rules, and using drugs, alcohol or tobacco under age.

WHAT THE COURT MAY DO

Delinquent: May be placed on probation under the supervision of a Probation Officer at home or in a group home or other restricted program. The Court may alternatively place a delinquent in the custody of the State Office of Juvenile Services (OJS) / Health and Human Services (HHS) where he/she may be supervised at home, in another placement in the community (such as foster care, group home, or residential treatment), or at the Youth Rehabilitation Treatment Center (YRTC) in Geneva or Kearney.

Commitment to Office of Juvenile Services / Health and Human Services (HHS): HHS provides Court-ordered services to youth including those of the Office of Juvenile Services, the Youth Rehabilitation Treatment Centers, and Out of Home Placement.

Status Offender: Special supervision may be required. Offender may be placed at home on Probation or made a State Ward through the Department of Health and Human Services for out-of-home placement or services in the home.

YOUR RIGHTS

You have a right to:

- Know what has been filed against you;

- An attorney (a Public Defender may be provided at no cost);

- Face and cross-examine witnesses;

- Present evidence in your own defense;

- Testify if you wish; however, you do not have to testify;

- Be advised by the Judge as to what the Court can do with you; and

- Appeal the Court’s decision to the Nebraska Court of Appeals or Nebraska Supreme Court.

ADVICE FOR COURTROOM BEHAVIOR

DO…

- Dress neatly and cleanly, as you would for an important meeting.

- Be 15 minutes early, so you are ready to attend the hearing on time.

- Speak loudly and clearly.

- Be honest and make eye contact when talking.

- Respond to Judge’s questions by saying, “Yes, Your Honor,” or “No, Your Honor.”

DO NOT…

- Curse, swear or lie;

- Get angry or roll your eyes;

- Walk out of the courtroom (you could be held in contempt;

- Speak or act rudely;

- Take a cell phone into the courtroom;

- Slouch or chew gum; or

- Wear sagging pants, offensive T-shirts or gang-related items.

DETENTION

Confinement in a locked facility for a period of time until your case is tried or a more suitable placement is found.

STAFF-INTENSIVE PLACEMENT

Unlocked staff-intensive placement for a period of time until your case is tried or a more suitable placement is found.

YOU MAY BE PLACED AT A DETENTION OR STAFF-SECURITY FACILITY IF YOU…

- ...fail to follow court orders (any law violation, including Court orders to obey your parents’ rules and curfew, and/or attend school).

- ...are a runaway youth (a history of running from home or if you run from your Court-ordered placement, such as foster or group home).

- …are a danger to yourself or others (violent, aggressive, gang-related behavior or use of alcohol or drugs).

- ...are being discharged unsatisfactorily from a placement facility. If you are not following rules of your Court-ordered placement and are discharged, you may be detained.

- ...an OJS evaluation is ordered to be done residentially.

An evaluation can be ordered by the judge to be completed while you are detained.

WHEN A YOUTH IN CHARGED WITH A CRIME:

| Step |

Description |

| 1. Arrest |

Upon arrest by Law Enforcement, the Officer may: 1) Street-

release, 2) Cite and release to a parent, or 3) Arrest and get authorization to detain.

|

| 2. Detention Decision |

If recommended by Law Enforcement, a Probation Officer assesses for detention or release to parent. If detained, the Deputy County Attorney reviews all information files the appropriate Petition and requests a hearing, which should be held in a timely manner. The Court reviews all facts and determines if further detention is needed. A Petition generally must be filed within 48 hours of detention, excluding weekends and holidays. If the youth is not detained, a report is forwarded to the County Attorney for a filing decision.

|

| 3. Filing |

A petition is filed in the court, or declined. The matter might be diverted without filing a Petition. The County Attorney may decide to charge the youth in Adult Court. If charged with a felony or misdemeanor, the youth could be detained.

|

| 4. Arraignment |

Prior to the hearing, the youth meets with his/her attorney to discuss charges and how to proceed. Through the attorney, a plea of admission, denial, or no contest is entered. If the youth denies the charge(s), the Court will schedule an Adjudication Hearing. If youth admits to the charge(s), the Court will schedule a Disposition Hearing and may order evaluations.

|

| 5. Adjudication |

This is the trial of the Petition, where the State must prove up on the charge(s). If Court finds the Petition to be true, Court acquires jurisdiction of the youth and the matter is then set for disposition. If the Petition is not found to be true, the case is dismissed.

|

| 6. Predisposition Investigation |

The Court may order a predisposition investigation (PDI) by a Probation Officer prior to the disposition hearing, which involves Collecting information from the youth, his/her family, the schools, previous mental health providers, and others. This is so the Judge can make an informed decision about how best to hold the offender accountable and address his or her specific needs. More evaluations may be required (such as chemical dependency or mental health). In abuse-neglect cases, the PDI and other evaluations are done by the Office of Juvenile Services (OJS).

|

| 7. Disposition Hearing |

Based on the PDI and other case information, the Court orders a plan to ensure accountability and rehabilitation. The plan could include out-of-home placement, further evaluation, treatment, probation, intensive supervision, or other services.

|

FREQUENTLY ASKED QUESTIONS

What is Juvenile Court?

Nebraska laws have separate guidelines for juveniles (as opposed to adults, age 18 and over) who have violated the law or have other behaviors in need of intervention. Juvenile Court involvement is not considered to be a criminal record, but is intended to provide the juvenile an opportunity for rehabilitation.

What is a petition?

A petition is a legal paper, filed in the Court, outlining why you are being brought to court.

How will I know when to go to court?

You will receive a summons or letter giving the date, time, and location. The number of times you attend depends on individual circumstances. Inform the Court and Probation Officer of address or telephone changes.

What if I miss a hearing?

The judge could order you to be picked up by law enforcement, detained, and brought before the Court to explain why you ignored the Court’s notice.

What if I do not follow the Court’s rules?

A motion to review or revoke your placement or probation may be filed by the County Attorney, asking the Court to place more severe requirements on your probation or place you in an institution or state juvenile correctional facility.

Can my record be sealed (kept confidential)?

You may ask the Court to seal your records. This sets aside the record and it cannot be opened without Court approval and good cause. However, even if sealed, certain persons or agencies may still be able to access your records.

What if I waive the right to an attorney?

If you do so, you would be representing yourself. If you do not have an understanding or knowledge of legal options and process (such as motions to make, how to call and examine witnesses, and how to request services from the Court), you may be adversely affected. Remember, you can request an attorney to represent you at any point in the process.

| Office |

Phone Number |

| Attention Center |

(308) 236-1922 |

| County Attorney’s Office |

236-1222 |

| County Court |

236-1228 |

| City of Kearney Attorney’s Office |

237-3155 |

| Crisis Assistance Center |

(800) 325-1111 |

| Detention Center |

(308) 233-5281 |

| District Court |

236-1246 |

Health & Human Services (HHS)

• Geneva/Kearney

• Office of Juvenile Services (OJS)

• Out-of-home Placements

• Youth Rehabilitation and Treatment Centers

|

865-5592 |

| Juvenile Diversion |

236-1922 |

| Truancy/Juvenile Diversion |

236-1920 |

| State Probation |

236-1251 |

| Buffalo County Sheriff |

236-8555 |

Kearney Police Department

• non-emergency

• EMERGENCY

|

237-2104

911 |

| Family Resource Council |

237-4472 |

| Nebraska Workforce Development |

865-5404 |

Region III

• Early Intensive Care Coordination

• Professional Partner Program

|

237-5113

Ext. 238

Ext. 238 |

| Buffalo County Community Health Partners |

865-2284 |

Each individual is entitled to be, and is capable of being, responsible for his or her lawful participation in society.

Revised from the Crime Commission brochure “A Guide to Juvenile Court for Parents & Children.”

A printer-friendly version of this page is available.

Domestic Violence

Purpose:

This Division seeks protection for victims of violence in intimate relationships through aggressive and consistent prosecution of offenders.

The Buffalo County Attorney recognizes the importance of communicating and cooperating with law enforcement and other public and private community agencies that provide services to families, victims, and perpetrators of domestic violence. A specialized Domestic Violence Prosecution Unit, in coordination with other community agencies, provides the best opportunity to achieve the following goals:

- To stop the violence.

- To protect the victim from additional acts of violence committed by the Defendant.

- To protect the children or other family members from exposure to, or possible injury from, domestic violence.

- To provide restitution to the victims.

- To hold the offender accountable for their violent conduct.

Policy:

The State of Nebraska has a critical interest in reducing the number of incidents of domestic violence and increasing the number of positive results in domestic violence prosecutions.

It is the position of the Buffalo County Attorney that the aggressive prosecution of domestic violence is necessary to protect victims and future victims of domestic violence.

Resources and Information

IF YOU OR SOMEONE YOU KNOW NEEDS HELP, CALL:

NATIONAL DOMESTIC VIOLENCE HOTLINE

(800) 799-7233

NATIONAL SEXUAL ASSAULT HOTLINE

(800) 656-4673

NEBRASKA DOMESTIC VIOLENCE/SEXUAL ASSAULT HOTLINE

(800) 876-6238

LINEA DE CRISIS EN NEBRASKA (EN ESPANOL)

(877) 215-0167

DO NOT USE E-MAIL TO REPORT CASES OF ABUSE.

IF THERE IS AN EMERGENCY CALL LOCAL LAW ENFORCEMENT IMMEDIATELY.

|

|

The S.A.F.E. Center

(The Spouse/Sexual Abuse Family Education Center)

3710 Central Avenue, Suite 10

Kearney, NE 68847

(308) 237-2599

(877) 237-2513

http://www.safecenter.org

All Services are Free & Confidential

24-hour Crisis Line

Crisis Support

Emergency Shelter

Support Groups

Supportive Atmosphere

Liaison with Community Agencies

Public Education Presentations

Protection Order Advocacy

Information & Referrals for:

Counseling, Housing, Legal Alternatives,

Emergency Assistance and much more!

Follow-up contact

|

|

Breaking the Silence: Information for Victims of Intimate Violence

A Victim’s Guide to the Nebraska Criminal Justice System

VINE (Victim Information and Notification Everyday)

VINE is a free automated service that monitors the custody status of adult inmates in all county jails and state prisons. You can arrange to receive telephone and e-mail notification when an offender’s custody status changes. Updated information is available 24 hours a day. VINE is available in English and Spanish and supported by 24-hour operator assistance.

The Nebraska VINE service is provided by the Nebraska Sheriff’s Association, Nebraska Domestic Violence Sexual Assault Coalition, Nebraska Coalition for Victims of Crime, Nebraska County Attorneys’ Association, Nebraska Department of Correctional Services, Nebraska Crime Commission and CJIS Advisory Committee.

NEBRASKA VINE NUMBER: 877-NE 4 VINE or (877) 634-8463.

Register or Find an Offender Online at www.vinelink.com

A Summary of Nebraska’s Legal System

Other Resources

Nebraska Department of Health and Human Services

Nebraska Domestic Violence/Sexual Assault Coalition (NDVSAC) and Hotline

Brochure

(800) 876-6238

National Domestic Violence Hotline

(800) 799-SAFE (800-799-7233)

US Department of Justice

Violence Against Women Website

Minnesota Center Against Violence and Abuse

National Organization for Victim Assistance

800-TRY-NOVA (800-879-6682)

National Victim Center

800-FYI-CALL (800-394-2255)

National Center for the Prosecution of Violence Against Women

National Center for Victims of Crime

Juvenile Diversion

Purpose:

The Buffalo County Juvenile Diversion Program is committed to assisting youth in avoiding delinquent and criminal behavior. Juvenile rehabilitation and accountability is the primary goal of the program.

Eligibility:

Individuals who wish to participate in the Juvenile Diversion Program must:

- Be between 12 and 18 years of age. (Juveniles 11 and younger will be assessed on a case-by-case basis.)

- Accept responsibility for their offense and acknowledge the extent of their involvement.

- Be willing to comply with all of the program requirements.

- Reside in Buffalo County.

Prior criminal and juvenile court records will be considered in the eligibility determination. The program is voluntary, and is a privilege, not a right.

Seriousness of the Offense:

In determining the eligibility of the juvenile to participate in Diversion, the County Attorney will consider the seriousness of the offense. These factors will be used:

- The juvenile’s previous encounters with the law, including delinquent behavior.

- The length of time over which any prior offenses occurred, and similarity of those offenses.

- Whether the offense involved violence, and whether it was premeditated.

- The number of victims involved in the offense.

- The potential for actual harm to the victim(s), even if unintended.

- The monetary value of any damages.

- The juvenile’s motives for committing the offense.

- The likelihood of future law violations

- Whether the juvenile is amenable to treatment.

Advantages to Participation:

Successful Diversion participants benefit in these ways:

- Criminal charges regarding the offense will be dismissed or not filed.

- Improvement in personal responsibility and coping skills.

- Opportunity to develop a sense of community responsibility and accountability.

Requirements:

- Assessment. Upon the offer by the County Attorney to participate in Diversion, the juvenile will complete an intake assessment. He or she will be required to meet with the Diversion Administrator to discuss the referral, the diversion process, and the offender’s willingness to participate. The youth’s history, family life, academic performance, and other relevant factors will be examined. The Diversion Administrator may also provide avenues for additional services and/or make referrals to other agencies.

- Drug/Alcohol Assessment. All youth who are referred with drug- or alcohol-related offenses will be required to get a complete professional drug/alcohol evaluation at their expense. The results of this assessment will be shared with the youth and their parent(s), and be required to follow the recommendations of the assessment.

- Drug/Alcohol Testing. Once accepted into the Program, continued use or possession of illegal drugs or alcohol will be forbidden. At any time while on Diversion, the youth may be required to submit to drug and alcohol screening. The Diversion Administrator may share the results of such testing with the County Attorney, who will consider whether the youth will be allowed to continue in the Diversion Program. An offender deemed no longer eligible for Diversion will be referred back to the court for formal charges.

- Curfews. After being accepted into the Juvenile Diversion Program, some participants may be required to observe a curfew. The juvenile, the parent(s), and the Program Administrator will help in determining the curfew times and conditions.

- Duration of the Program. The Program will be tailored to the individual needs of the juvenile. Consequently, the duration of the program will depend on the offender. The maximum term of Diversion will not exceed one year.

- No Plea Required. While the participant must acknowledge their participation in the offense, they will not be required to enter a court plea of “admit” or “no contest.” The County Attorney will not use any admissions if charges are subsequently filed.

- Victim/Offender Mediation. If the victim agrees, the offender may be considered for mediation.

- Sponsor. A juvenile participating in Diversion will be asked to have a responsible adult as their sponsor. The Program Administrator must approve the sponsor. The sponsor may be a parent, relative, or friend.

Specific Requirements May Include:

- Paying all required fines, fees, and restitution.

- Satisfactorily completing all required community service.

- Attending and participating in all educational classes.

- Writing a letter of apology to the victim(s).

- Informing the school in writing about participation in the Diversion Program and serving all, if any, school-related consequences.

- Avoiding social situations that may involve criminal or delinquent behavior.

- Obeying school and household rules, and working towards a good academic standing.

- Receiving no additional violations and obeying the rules of the Program.

- Signing a release of information permitting open communication with the school and other interested parties and the Diversion Program.

- Each individual is entitled to and capable of being responsible for his or her lawful participation in society.

How to Apply:

If you are offered Diversion, please complete our Youth Questionnaire and Parent Questionnaire, then call the Diversion office at (308) 236-1922 for an appointment.

Truancy office phone number is (308) 236-1920

Child Support Enforcement FAQ

Do you charge for your services?

There is a $25.00 annual fee for child support enforcement services, but you will not be billed or asked to pay the fee directly. Instead, the fee is collected out of child support payments made by the person owing the child support. The fee is collected in cases where at least $500.00 per fiscal year (Oct. 1-Sept. 30) in child support is collected. Under no circumstances will parents who are receiving state aid be required to pay a service fee.

What services do you offer?

We offer paternity establishment services, as well as enforcement services for existing child support, spousal support, and medical support orders.

Must I live in Buffalo County to make use of your services?

If you are a Nebraska resident applying for paternity services, you should contact the child support office in the county where you live. That would typically be your local County Attorney’s Office. If you live in Buffalo County, contact us at the address above. If, on the other hand, you live in another county and have a support order already existing, you should contact the child support office in the county where that order exists, even if you have moved to another county since then. If you child support order comes from another state, you may either work through your local county child support office, or contact the child support office in the other state directly.

Do you handle custody or visitation issues?

No. State law prohibits us from assisting on these issues. You should contact private counsel to assist you, or contact Legal Aid of Nebraska to see if you qualify for their services. Some employers offer legal insurance plans, much like medical insurance, so check to see if your employer offers such assistance.

I was previously ordered to pay child support, but now my child lives with me. Can you stop my child support order, and help me get a new one where the other parent pays me instead?

Only a court can legally change an existing child custody order. Courts determine what is in the “best interests” of the child when they issue a custody order, and parents cannot agree between themselves to override a judicial determination. A child support enforcement office is not authorized to become involved with custody determination issues. You should consult a private attorney to assist you.

The other parent of my children has a violent temper, and has threatened to hurt me and/or our children if I pursue them for child support. What can you do to help me?

We are very aware that many couples separate because of domestic violence issues. Your safety, and the safety of your children, is our #1 concern. Everyone who applies for child support or paternity services, whether through an HHS caseworker or directly with our office, will be asked about this potential problem. If you tell us you are concerned about the potential for family violence, we will give your case special treatment. Each case is handled on its own set of facts. A decision may even be made not to pursue the other parent due to the threat of his or her becoming abusive to you or your children.

If you have immediate concerns about possible violence to you or your children, we urge you to call 911. Otherwise, contact the SAFE Center.

I already have an existing child support order, but now the noncustodial parent is making much more money. Can my support order be modified to have the other parent pay me more support?

Yes. Whenever (1) there is a material change in financial circumstances of a parent who is ordered to pay support, (2) the change of financial circumstances was unforeseen at the time your support order was entered, (3) the change in circumstances has lasted at least three months, and is expected to last at least six additional months, and (4) the modification request is processed through the HHS Review & Modification office, your support order may qualify for modification. A “material change in financial circumstances” usually means an increase or decrease of support by at least 10% but not less than $25.00. If you (or the other parent) continue to live in Nebraska, and if your order is at least 3 years old, you may ask the State to process your request for a modification free of charge. Contact the HHS Review & Modification office at (800) 831-4573 for more information, or see Creating or Changing a Court Order. If your order is less than three years old, or if neither parent continues to reside in Nebraska, you would be responsible for pursuing your modification request on your own, with your own attorney. See the Nebraska Child Support Guidelines for more information.

I am ordered to pay child support, but I no longer earn as much as I used to, and I have been unable to find similar employment that pays as much as my old job. Can I get my child support reduced on account of my earning less now?

Possibly. Child support can be modified either upward or downward if the circumstances justify it. Generally, child support may not be reduced unless the parent who is ordered to pay support suffers a long-term reduction in their earning capacity or income through no fault of their own. Examples of this would include corporate downsizing, the elimination of specialized work that cannot easily be replaced at the same pay level, or a medical disability or injury that occurs to the parent who pays support. Incarceration is, by itself, usually not considered to be valid grounds for a reduction in child support.

If you believe you qualify for a support reduction, and want to expedite the matter, you should contact a private attorney to assist you in your efforts. Otherwise, you (or the other parent) may contact the HHS Review & Modification office at (800) 831-4573 for further assistance free of charge.

How long does it take to have a support order modified?

Every case is unique, but from the time contact with the HHS Review & Modification office is initiated until the time that the court has a final hearing on a request to modify child support of child support, nine to 12 months may pass. Typically the first three to four months of the time is taken up in the HHS review process. If the case meets a preliminary finding that a modification is appropriate, the request will be transferred by HHS to the local child support office for further review, and the possible filing of a complaint to modify support. Depending upon any delays in obtaining court service of process on the other parent, delays caused by legal motions or court scheduling issues, the modification case should be ready for trial and decision about four to six months after it is filed.

Why can I not call your office directly to discuss my case?

Several years ago Nebraska, like all 50 states, went to a centralized customer call center. This center is staffed by highly trained personnel who are able to immediately answer or assist about 90% of all callers. Most calls are of a “routine” nature, such as checking to see if payments have been credited, wanting to confirm court hearing dates, providing a change of address, employer or phone number. Whenever necessary, the call center will electronically contact a local child support office with a customer concern that needs additional attention. Some of those calls do lead to phone contact between local staff and our customers. By answering 90% of caller questions, the call center frees up valuable time for the local child support workers to perform their duties on an uninterrupted basis, adding to their productivity. It is a “win-win” arrangement for everyone. Call the Child Support Call Center at (877) 631-9973, or the HHS Review & Modification office at (800) 831-4573.

My case is classified as “Interstate” in nature, because I live in a different state from the other parent. Does this mean that I will not be able to get the help I need?

No, definitely not. It is true that interstate cases often take longer to work successfully than cases where everyone still lives locally. About 15-20% of our caseload is interstate. In most of those cases our staff will need to work with other child support offices, sometimes in more than one other state, in order to secure the cooperation necessary to establish a new support order, or enforce an existing order. The extra “hoops” that must be jumped through mean that legal actions do take longer to complete. We have found that many other child support offices are overstretched in terms of personnel and funding, and thus are unable to assist us as quickly as they might like. In addition, sometimes when parents leave one state they move in order to evade their child support orders. Some people become very good at hiding from law enforcement. Fortunately, our tools for finding them continue to get better all the time as well.

What sanctions are used to force parents to pay their child support?

Most parents with child support orders pay regularly. Most do so on their own; others need a degree of prompting. Income withholding, civil contempt of court, license suspension, bank account seizure, passport denial, tax refund intercept, and even criminal actions are among the more readily used tools at our disposal to enforce terms of court orders. The simplest, quickest and least expensive enforcement techniques are used first, and often get the results we seek.

I owe child support, but I never get to see my child. Why should I have to pay support when I do not get the parenting time I deserve?

Nebraska law is clear: An obligation to pay child support is completely separate and distinct from the right to exercise parenting time. The failure to obtain court ordered parenting time (sometimes called visitation) does NOT justify the non payment of support. Also, the failure to receive child support does NOT justify a refusal to allow the other parent to exercise their court ordered parenting time. Just as our judges will not tolerate persons who willfully fail to pay their support on time, those same judges will not tolerate parents who refuse to allow the other parent court ordered parenting time with their children. The method of enforcing a problem with parenting time is to take the other parent back to court for allegedly being in contempt of the court order. A private attorney can provide needed expertise to accomplish this task.

What is the age of emancipation in Nebraska?

Emancipation age in Nebraska is presently 19, and child support must be paid until the month and year the child reaches that age. In most other states the age of emancipation is 18. Some states (not Nebraska) allow for support orders to continue beyond the age of the child’s emancipation if the child is still a full time high school student. Look to the language in your support order to see how long your child support is to continue.

Bad Checks

Purpose:

The Division is responsible for processing and follow-up investigation of any Non-Sufficient Funds or Account Closed checks that are submitted for criminal prosecution.

Victims of bad checks, who are considering criminal prosecution of a suspected bad check writer, must submit the original check(s) in question, or what is provided to them by the bank, along with the statutorily-mandated fee of $10.00 per check.

Should the victim so desire, a criminal arrest warrant may be issued for the check writer. In order to successfully prosecute bad check offenders, it is necessary that we receive certain information about the bad check writer. This increases our chances of proving the case in court and obtaining full restitution for the victim.

Should the victim so desire, a criminal arrest warrant may be issued for the check writer. In order to successfully prosecute bad check offenders, it is necessary that we receive certain information about the bad check writer. This increases our chances of proving the case in court and obtaining full restitution for the victim.

You may establish your own business or personal procedures regarding what types of checks you will accept. For purposes of criminal prosecution, however, you should not accept a check from any individual who cannot produce a valid photo identification that matches the account name on the check. The most helpful information for merchants to note on a check they are receiving is the date of birth of the individual, and the driver’s license number with issuing state. This information should always be written on the check by the merchant’s employee rather than the check writer. Your employee should also note that they compared the photo ID to the check writer with a notation such as, “I.D. checked.” Furthermore, your employee should note their own initials on the check to identify the employee who received the check. This is necessary because it is often most difficult to prove in court the person who wrote the bad check is the same as the person charged with the crime.

To help us collect the information, please complete our Request for Criminal Prosecution on Bogus Checks form. The information is vital to obtain an arrest warrant and prove the identity of the issuer of the bad check. Although we take the initial steps toward obtaining restitution for you, without your cooperation we may not be able to prosecute the case.

Please contact our office at (308) 236-1289 if you have questions.

Marriage License

Requirements for a marriage license issued by Buffalo County:

| 1. |

Applicants must be at least 17 years of age to be married in the state of Nebraska. Parental consent is required for applicants who are 17 or 18 years of age. The parental consent forms are available at the County Clerk's office.

|

| 2. |

Both applicants must appear together at the County Clerk's office between the hours of 8 a.m. and 4:30 p.m. on weekdays.

|

| 3. |

The fee for a marriage license is $25.00, CASH ONLY. (See our ATM locations in the courthouse.) |

| 4. |

Must present photo identification. A valid driver's license from any U.S. state, Nebraska ID card, U.S. Passport, U.S. Military card, or a Foreign passport are acceptable forms of photo identification. All documents will be in English or translated by a certified court translator. Proof of citizenship or immigration status is neither relevant or required.

|

| 5. |

Need to know birthplace for both applicants. |

| 6. |

Need to know full names and birthplaces of parents.

|

| 7. |

If a social security number has been issued to the applicants, we will need that information. The issuance of a social security number to either applicant is not required to obtain a Marriage License.

|

| 8. |

If there were any previous marriages we will need to know how they ended (divorce, annulment or death) and the date the divorce was final or the date of death. If there is a previous divorce, a new license will not be issued and you cannot remarry until at least six (6) months and one (1) day have passed from the date the Decree was signed by the judge and filed with District Court.

|

| 9. |

The Marriage License is good for one year from the date of issuance and can be used in any County in Nebraska.

|

| 10. |

All marriage licenses obtained in Nebraska are public record.

|

All marriage licenses obtained in Nebraska are public record.

For information about scheduling the Buffalo County Court Magistrate to conduct a marriage ceremony, contact Sharmin Gonzales at sharmin.gonzales@nejudicial.gov or 308-236-1229.

Certified copy of a Buffalo County marriage license

To Receive a Buffalo

County certified marriage license either stop by the clerk’s office with $9.00

cash or send a $9.00 money order and the following information:

- Name of Applicant A/Groom

- Name of Applicant B/Bride

(including maiden name)

- Date of marriage (Must be issued from Buffalo County)

Mail to:

Buffalo County Clerk

PO Box 1270

Kearney, NE 68848-1270

If you have any questions, contact us by:

Phone: (308) 236-1226

E-mail: clerk@buffalocounty.ne.gov

Changing name after

the wedding

This is a personal decision. You may choose to keep your name but if you decide to change your name legally, you should do the paperwork as soon as possible after you're married (or after your honeymoon). Many entities will require you to present a certified copy of your marriage license as proof of legal status to make your name change. Photocopies and keepsakes are not recognized by most government offices as proof of marriage. The following is a list of what may need to be updated.

- Social Security Card (require certified copy)

- Bank, credit union, and investment accounts

- Vehicle title/registration

- Driver's license (require certified copy)

- Mortgage

- Homeowner's insurance

- Life insurance

- Car insurance

- Medical and dental records

- Credit cards and files

- Deeds and property titles

- Passport

- Voter registration card

- IRS forms

- Church records

- Mail and newspaper subscriptions

- Employer/payroll

- Post office

- Your attorney (to update legal documents, will)

- Military records

- Utilities/Subscriptions

Return to top

THIS INFORMATION IS SUBJECT TO CHANGE WITHOUT FURTHER NOTICE.

Wireless Emergency Alerts

To enhance public safety, a free Wireless Emergency Alerts service is rolling out. WEA (pronounced “wee”) messages are text-like alert messages received by your mobile device during an emergency in your area. The purpose of WEA is to provide an increasingly mobile American public with a free and fast way to receive critically important information.

Frequently Asked Questions:

Why is this important to me?

Alerts received at the right time can help keep you safe during an emergency. With WEA, alerts can be sent to your mobile device when you may be in harm’s way, without need to download an app or subscribe to a service.

What are WEA messages?

Wireless Emergency Alerts (WEA) are emergency messages sent by authorized government alerting authorities through your mobile carrier. Government partners include local and state public safety agencies, FEMA, the FCC, the Department of Homeland Security, and the National Weather Service.

What types of alerts will I receive?

- Extreme weather, and other threatening emergencies in your area

- AMBER Alerts

- Presidential Alerts during a national emergency

What does a WEA message look like?

WEA will look like a text message. The WEA message will show the type and time of the alert, any action you should take, and the agency issuing the alert. The message will be no more than 90 characters.

How will I know the difference between WEA and a regular text message?

WEA messages include a special tone and vibration, both repeated twice.

What types of WEA messages will the National Weather Service send?

- Tsunami Warnings

- Tornado and Flash Flood Warnings

- Hurricane, Typhoon, Dust Storm and Extreme Wind Warnings

- Blizzard and Ice Storm Warnings

What should I do when I receive a WEA message?

Follow any action advised by the emergency message. Seek more details from local media or authorities.

Will I receive a WEA message if I’m visiting an area where I don’t live, or outside the area where my phone is registered?

Yes, if you have a WEA-capable phone and your wireless carrier participates in the program. For information about which mobile devices are WEA-capable and carrier participation, please visit http://www.ctia.org/wea or contact your wireless carrier.

What if I travel into a threat area after a WEA message is already sent?

If you travel into a threat area after an alert is first sent, your WEA-capable device will receive the message when you enter the area.

When will I start receiving WEA messages?

It depends. WEA use begins in the spring of 2012, but many mobile devices, especially older ones, are not WEA-capable. When you buy a new mobile device, it probably will be able to receive WEA messages. For information about which mobile devices are WEA-capable, please visit http://www.ctia.org/wea or contact your wireless carrier.

Is this the same service public safety agencies have asked the public to register for?

No, but they are complementary. Local agencies may have asked you to sign up to receive telephone calls, text messages, or emails. Those messages often include specific details about a critical event. WEA are very short messages designed to get your attention in an emergency situation. They may not give all the details you receive from other notification services.

Will I be charged for receiving WEA messages?

No. This service is offered for free by wireless carriers. WEA messages will not count towards texting limits on your wireless plan.

Does WEA know where I am? Is it tracking me?

No. Just like emergency weather alerts you see on local TV, WEA are broadcast from area cell towers to mobile devices in the area. Every WEA-capable phone within range receives the message, just like every TV shows the emergency weather alert if it is turned on. TV stations, like WEA, don’t know exactly who is tuned in.

Will a WEA message interrupt my phone conversations?

No, the alert will be delayed until you finish your call.

How often will I receive WEA messages?

You may receive frequent WEA messages during an emergency. Message frequency depends on the number of imminent threats to life or property in your area.

If, during an emergency, I can’t make or receive calls or text messages due to network congestion, will I still be able to receive a WEA message?

Yes, WEA messages are not affected by network congestion.

What if I don’t want to receive WEA messages?

You can opt-out of receiving WEA messages for imminent threats and AMBER alerts, but not for Presidential messages. To opt out, please refer to instructions from your wireless carrier or visit http://www.ctia.org/wea for more information.

How will I receive alerts if I don’t have a WEA-capable device?

WEA is one of many ways you can receive emergency notifications. Other sources include NOAA Weather Radio, news media coverage, the Emergency Alert System on radio and TV broadcasts, social media, and other alerting methods offered by local and state public safety agencies. Your best use of WEA is to immediately seek additional information about the imminent threat impacting your area.

A flyer with more information about

Wireless Emergency Alerts is available.

Safe Room Q & A

What is a safe room? What are the design requirements for a FEMA safe room?

A safe room is a hardened structure specifically designed to meet FEMA criteria and provide "near-absolute protection" in extreme weather events, including tornadoes and hurricanes. The level of protection provided by a safe room is a function of its design parameters, specifically the design wind speed and resulting wind pressure and the wind-borne debris load resistance. To be considered a FEMA safe room, the structure must be designed and constructed to the guidelines specified in FEMA P-320, Taking Shelter

from the Storm: Building a Safe Room for Your Home or Small Business (FEMA, third edition, 2008a) (for home and small business safe rooms). Additionally, all applicable Federal, State, and local codes must be followed. When questions arise pertaining to the differences between FEMA P320 criteria and another code or standard, the most conservative criteria should apply.

Should I have a safe room?

Pages 6 through 10 of FEMA P-320 (FEMA, 2008a) provide background information to help homeowners decide if a safe room is needed in their home. Homeowners and small-business owners should also refer to the Homeowner’s Worksheet, Assessing Your Risk (Table I-1) in FEMA P-320 (FEMA, 2008a); this is an easy-to-use matrix that helps users decide whether a safe room is a matter of preference, should be considered, or is the preferred method for protection from extreme winds.

My house has a basement. Do I need a safe room?

Some strong tornadoes have resulted in loss of floor framing, collapse of basement walls, and death and injuries to individuals taking refuge in a basement. What constitutes an acceptable level of protection is an individual decision. A basement may be the safest place to seek shelter for homes without a safe room, but it will not provide the same level of protection as a safe room unless it has been designed and constructed to provide the level of protection in accordance with FEMA P-320 (FEMA, 2008a) and FEMA P-361 (FEMA, 2008b).

A basement is a good location to install a shelter or build a safe room, but access for handicapped or physically challenged individuals may be limited. The flood risk of your location may also affect whether it is appropriate to place a safe room in your basement. If your house or neighborhood is prone to flooding, the basement may not be an appropriate location for taking refuge.

Where can I find information about obtaining FEMA funding to construct a safe room? Are there any funds available in my area?

For project eligibility and financial assistance questions, please contact your Local Emergency Manager. Your Emergency Manager can advise you on what information must be provided for your project to be considered for funding, as well as any applicable Federal, State, and local design requirements.

Can I still apply for FEMA funding after I have begun construction of a safe room or purchased a safe room?

No. You must apply for funding before the purchase of a safe room or beginning any construction. Section D.2, Part III of FY 2011 Hazard Mitigation Assistance Unified Guidance (FEMA, 2010) states that costs related to projects for which actual physical work (such as groundbreaking, demolition, or construction of a raised foundation) has occurred prior to award or final approval are ineligible.

What costs are eligible for funding under a safe room grant?

Allowable costs for safe room projects funded under FEMA’s Hazard Mitigation Grant Program (HMGP) are those components related to, and necessary for, providing life safety for building residents in the immediate vicinity during an extreme-wind event. The funding covers design and building costs related to structural and building envelope protection. The funding covers both retrofits to existing facilities and new construction projects, and applies to both single- and multi-use facilities.

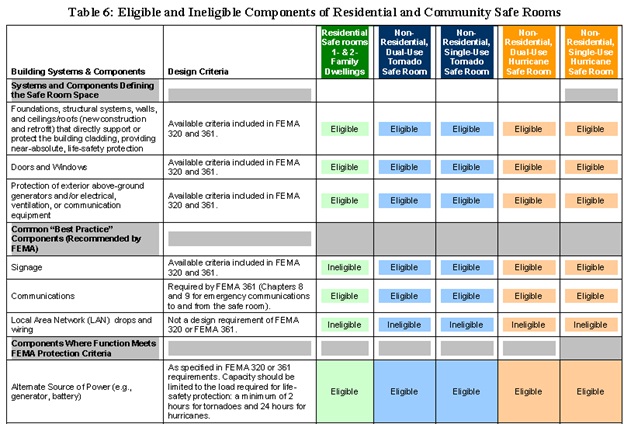

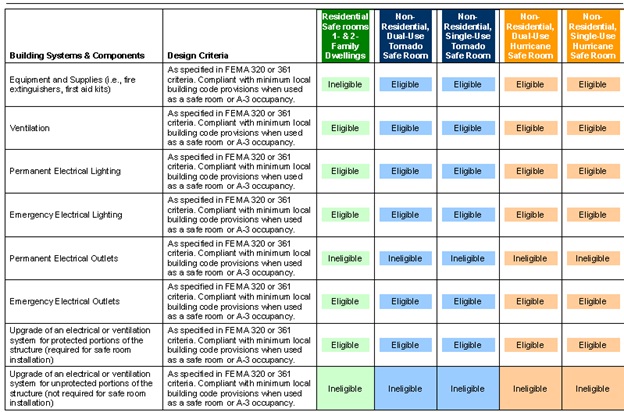

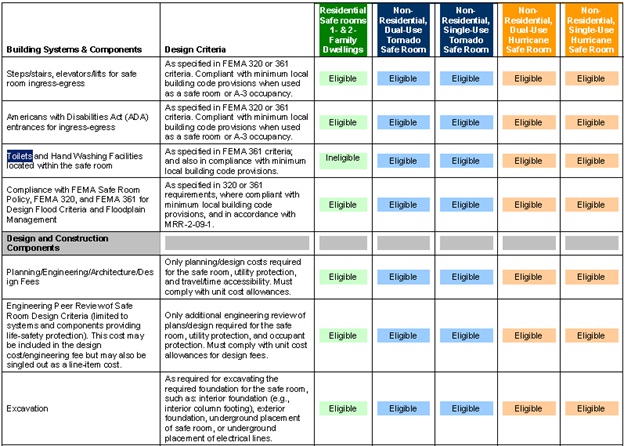

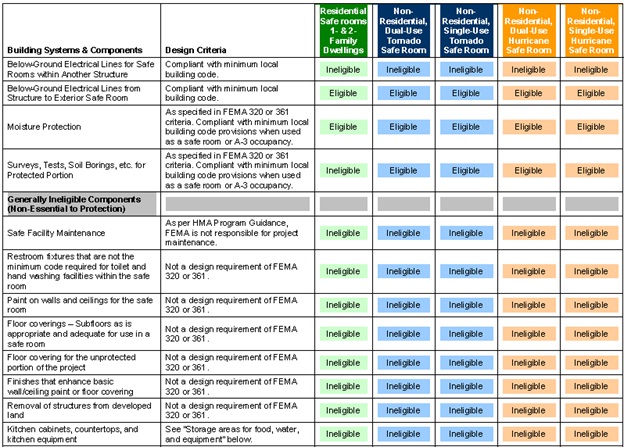

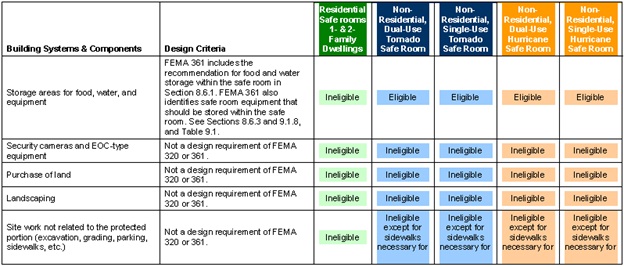

Eligible costs are only those consistent with FEMA-approved performance criteria as provided in FEMA P-320 (FEMA, 2008a). These criteria are summarized in Table 6 (below) of the 2011 FY FEMA Hazard Mitigation Assistance Unified Guidance (FEMA, 2010). (Click the table to view it larger.)

Does FEMA approve, endorse, or certify any products?

No. Federal No. Federal policy does not allow FEMA to approve, endorse, certify, or recommend any products. While a product may be in compliance with FEMA design guidance, any language from manufacturers stating their product is "FEMA approved" or "FEMA certified" is incorrect.

What is the recommended square footage per person for a residential tornado and hurricane safe room?

For residential safe rooms, the usable tornado safe room floor area should be the gross floor area minus the area of sanitary facilities, if any, and should include the protected occupant area between the safe room walls at the height of any fixed seating, if it exists. The minimum recommended safe room floor area per occupant for residential tornado and hurricane safe rooms is provided in table below. (Click the table to view it larger.)

What is the cost of installing a safe room in a new home or small business?

Costs for construction vary across the United States. The cost for constructing a safe room that can double as a master closet, bathroom, or utility room inside a new home or small business ranges from approximately $6,600 to $8,700 (in 2011 dollars). This cost range is applicable to the basic designs in FEMA P-320 (FEMA, 2008a) for an 8-foot by 8-foot safe room (approximately 64 square feet of protected space). Larger, more refined designs for greater comfort cost more, with 14 foot by 14-foot safe rooms ranging in cost from approximately $12,000 to $14,300. The cost of the safe room can vary significantly, depending on the following factors:

- The size of the safe room

- The location of the safe room within the home or small business

- The number of exterior home walls used in the construction of the safe room

- The type of door used