Facilities General Information

The Buffalo County Facilities OMP department strives to provide extraordinary, professional and reliable building management services for all of the county facilities. Our Facilities Staff are trained professionals who are committed to providing a clean, safe, secure and functional building environment for both the county staff and the general public. Buffalo County Facilities OMP includes Operations (Custodial and Maintenance), Management (Facility Rental Use and Administrative Services), and Planning (Short term and long term improvements).

The 14 members of the Facilities OMP staff are responsible for maintaining all County Government buildings, including the Courthouse, Judicial Center, County Jail, Highway Department

buildings, Extension Building, 4 office buildings, and a recreation area with a lake and campground. There are over 30 buildings in total. In addition to these facilities, Facilities OMP maintains 11 parking lots, all walkways, steps and lawns adjacent to these areas, including landscaping, and provides snow and ice removal during the winter. The staff meet regularly to review work practices and safety regulations. They take part in additional training to keep up to date on the latest practices and procedures

relative to the cleaning, maintenance, security, and protection of County facilities, employees, and the general public.

"Facilities Operations" includes:

Custodial Services

Our Custodial Staff are trained cleaning professionals who are committed to providing a safe, clean and presentable building environment. We provide custodial services for 10 of our County buildings, their entrances, surrounding grounds, and parking areas. These buildings include:

--Buffalo County Courthouse

--Buffalo County Judicial Center

--Buffalo County Jail/EOC Center

--DHHS

--Adult Probation

--Juvenile Probation

--Extension Building

--215 Office Building

--Buffalo County Highway Department

--Buffalo County Weed District

Maintenance Services

Our Maintenance Staff are trained maintenance professionals who are committed to providing a safe, secure and functional building environment. Their work includes:

--Planned/Preventative Maintenance - includes inspections, servicing, general upkeep to buildings, equipment and grounds.

--Reactive/Unplanned Maintenance - repairing breakdowns of our facilities and grounds

--Overseeing underground fuel storage tanks/piping/lines and ensuring compliance with government regulations

--Monitoring/Maintaining Building Management Systems including HVAC controls, fire alarm systems, etc.

--Emergency Maintenance - assessing/repairing/coordinating repairs to critical system breakdowns

--Snow and Ice Removal

"Facilities Management" includes:

Facility Rental Use

The Facilities OMP department is responsible for facilitating the rental use of county facilities. At this time the principle location of this usage is the Buffalo County Extension Building. The responsibility includes:

--Schedule the usage of the Extension Building meeting rooms & kitchen, and maintain the master schedule

--Process all requests for usage of the meeting rooms & kitchen, and insure compliance with Board policies and regulations

--Execute rental contracts for outside group usage and collect rental fees associated with each agreement

--Verify appropriate requirements are met by groups using the facility

--Provide Facility Assistant when required, for groups with alcohol

--Provide proper access to scheduled groups

--Prep building for usage and follow up to ensure that it has been returned in proper condition

Administrative Services

Operations

--Ensure compliance with employment rules/regulations, county policies, and all applicable state and federal laws/regulations

--Oversee the daily operations of the Facilities OMP workforce and the work assignments

--Monitor, inspect and review the daily operations of the County facilities and grounds

--Manage installations, repairs, equipment testing and contracted maintenance by outside sources

--Oversee the development and implementation of operational policies and procedures

--Utilize and administer facility/building management software systems to manage the county facilities

--Coordinate professional development of Facilities OMP staff through training and workshops

--Have a representative on the County safety committee and any other committee as requested

Procurement

--Review and manage contracts related to county facilities

--Manage Facilities OMP equipment, materials and supplies and order inventory/supplies when needed

--Develop and maintain strong vendor and contractor partnerships to ensure the best quality, cost, and customer service for the County.

--Procure building equipment and supplies as needed for facilities

Claims/Accounts Payable

--Review and keep record of monthly bills and claims against Facilities OMP, including all utility bills for all County buildings

Budget

--Develop and manage Facilities OMP budgets, including preparing and maintaining a yearly budget

--Create cost estimates for anticipated individual projects.

--Manage budgeted costs on projects as they occur.

Management Software System - Facility Dude

--Facility management software utilized by the County

--Work tickets are generated by county employees needing custodial or maintenance assistance. All work requests need to be submitted on a work request utilizing Dude Solutions software (FacilityDude).

--Work tickets are assigned to Facilities staff and/or contractors for work orders

--Additional "preventative maintenance" work tickets are also generated with FacilityDude for scheduled servicing/inspecting/upkeep.

--Once the work has been completed, the work tickets are closed out and a follow up email is sent to the requestor to let them know that the work has been completed

--Data is collected from the information inputted into FacilityDude and utilized for managing current costs and projecting future expenses/budgeting

"Facilities Planning" includes:

Planning, Design & Development

--Develop and implement one, two and six year department plans

--Small Scale - Develop and implement small scale adjustments to

existing spaces to keep space up to date and adequate for current

usage needs.

--Large Scale - Coordinate design, engineering and construction of all Capital improvements including new buildings, new additions to existing buildings, and remodels of existing buildings.

--Ensure compliance with all applicable local, state and federals laws and regulations related to buildings and grounds

About this Office

The County Assessor is an elected office with a 4-year term. To occupy the office one must pass a test and hold a valid Nebraska Assessor Certificate from the Property Tax Administrator. The assessor must meet all standards set forth by statute and regulations to maintain the certificate to include 16 hours of continuing education each year.

The Assessor is responsible for the valuation of approximately 25,000 parcels of real estate and 3,250 parcels of personal property. Approximately 1,200 homestead exemption applications and 250 permissive exemption applications are collected and processed. A response is made for many requests from the public or other offices for information, research or copies of public records each year.

Services of this Office

The Assessor's duties are prescribed by Nebraska Statutes, (Chapter 77), and Rules and Regulations promulgated by the Nebraska Property Tax Administrator which have the effect of law.

- Establish and maintain fair and equitable value on all real and personal property within the county.

- Attend all meetings of the County Board of Equalization.

- Review all applications for religious, charitable and educational tax exemptions.

- Accept and process homestead exemption applications.

- Accept and process personal property schedules.

- Verify and maintain a sales file for all property sales within the county.

- Respond to requests for information from the public.

Additional services include online property searches and in-office sales file searches. There may be a fee on copies that are for other than personal use. Please contact our office for further information.

2017 Board of Commissioners Agendas/Minutes/Notices

Buffalo County furnishes the public information contained herein as a public service. This information may not reflect the most recent resolutions of the County Board and if the resolutions need to be legally relied upon, the most current version may be obtained at the office of the County Clerk. Please also read the disclaimer statement.

Open Meetings Act (effective July 19, 2012).

Zoning packets are available upon request from the Zoning Administrator.

Please choose the Agenda you wish to view from the list below.

Notice

Board Meeting Notices, Agendas, and Minutes

| Date |

Notice |

Agenda |

Minutes |

| January 10, 2017 |

Notice |

Agenda |

Minutes |

January 19, 2017

Emergency Meeting |

Notice

|

Agenda |

Minutes |

| January 24, 2017 |

Notice |

Agenda |

Minutes |

| February 14, 2017 |

Notice |

Agenda |

Minutes |

February 24, 2017

(County Assessor Interviews) |

Notice |

Agenda |

Minutes |

| February 28, 2017 |

Notice |

Agenda |

Minutes |

| March 14, 2017 |

Notice |

Agenda |

Minutes |

| March 28, 2017 |

Notice |

Agenda |

Minutes |

| April 11, 2017 |

Notice |

Agenda |

Minutes |

| April 25, 2017 |

Notice |

Agenda |

Minutes |

| May 9, 2017 |

Notice |

Agenda |

Minutes |

| May 23, 2017 |

Notice |

Agenda |

Minutes |

| June 13, 2017 |

Notice |

Agenda |

Minutes |

June 27, 2017

|

Notice |

Agenda |

Minutes |

July 11, 2017

|

Notice |

Agenda |

Minutes |

July 11, 2017

(Board of Equalization) |

Notice |

Agenda |

Minutes |

July 18, 2017

(Board of Equalization) |

Notice |

Agenda |

Minutes |

July 21, 2017

(Board of Equalization) |

Notice |

Agenda |

Minutes |

July 24, 2017

(Board of Equalization) |

Notice |

Agenda |

Minutes |

| July 25, 2017 |

Notice |

Agenda |

Minutes |

July 25, 2017

(Board of Equalization) |

Notice |

Agenda |

Minutes |

| August 8, 2017 |

Notice |

Agenda |

Minutes |

| August 22, 2017 |

Notice |

Agenda |

Minutes |

| September 12, 2017 |

Notice |

Agenda |

Minutes |

| September 25, 2017 |

Notice |

Agenda |

Minutes |

| September 26, 2017 |

Notice |

Agenda |

Minutes |

| October 10, 2017 |

Notice |

Agenda |

Minutes |

| October 24, 2017 |

Notice |

Agenda |

Minutes |

| November 14, 2017 |

Notice |

Agenda |

Minutes |

| November 28, 2017 |

Notice |

Agenda |

Minutes |

| December 12, 2017 |

Notice |

Agenda |

Minutes |

| December 26, 2017 |

Notice |

Agenda |

Minutes |

2016 Archive

2015 Archive

2014 Archive

2013 Archive

2012 Archive

2011 Archive

2010 Archive

Assessor Mission Statement

The Buffalo County Assessor’s Office is dedicated to establishing fair and equitable assessments for the citizens of Buffalo County in accordance with state statutes approved by the legislature and regulations set forth by the Nebraska Department of Revenue Property Tax Administrator.

Assessor Calendar

| |

|

| Jan 01 |

Assessment of Real Property (Discovery, List, Value) 77-1301

|

| Jan 01 |

Assessment of Personal Property (Discovery, List, Value) 77-1201 |

| Jan 01 |

R R & Pub Serv req’d Report Non-Operating

Property to Assessor. 77-606 & 77-801 & Calendar

for Railroads & Public Service Entities. |

| Jan 01 |

Effective Date for Filing: Homestead Exemption Claimants MUST be (a) Owner of Record and (b) Occupy the homestead. (c) MUST be 65 or older.(d) Effective Date of Disability and Filing Status. 77-3502 77-3505 |

| Jan 15 |

Mobile Home Court Owner et al files Report w Assessor 77-3706 |

| Jan 31 |

Gov’l Subdivisions provide Assr Off w COPIES OF LEASES or descriptions of Leased property. 77-202.11

|

| Jan 31 |

Deadline for county Board of Equalization to petition the Tax Equalization & Review Commission for use of a different approach to value rent-restricted housing projects. (LB 356) 77-1333

|

| Feb 01 |

Assessor makes recommendations on permissive exemption applications Form 451. To Board of Equalization. Notice must be published in the paper, ten days prior to consideration of applications by the B O E that a list of organizations seeking permissive exemptions, legal descriptions, and Assessor

recommendations is available in the Assessor’s Office. 77-202.01 |

| Feb 01 |

Statements of Reaffirmation Form 451A do not need to be approved by the BOE only by Assessor. 77-202.01

|

| Feb 01 |

Assr issues notice of approval / denial Beginning Farmer Exemption Form 1027 77-5209.02 |

| Feb 01 |

Aircraft Report filed with Assessor. 77-1250.02

|

| Feb 01 |

Last day P.T.A. provide counties w Printed Claim Forms and Address Lists of prior year applicants. 77-3510

|

| Feb 01 |

First day for claimants to file NE Homestead Exemption App or Certification of Status. May fall on Feb 2 or 3 if Feb 1 is on Sat or Sun. 77-3512, 77-3513, 77-3514 |

| Feb 28 |

Seeking Separate Taxation of IOLL &

LAND File Form 402 Improvements on Leased Land Assessment Application 77-1376

|

| Mar 01 |

Certify to P.T.A whether or not Ag & Hort Land are influenced by prices outside of the typical ag-hort land market. REG 17-003.03

If Special Valuation is used, must file specific information w P.T.A.. REG 11-005.04

|

| Mar 01 |

Improvements owner on LEASED PUBLIC LAND may file Form 402P Improvements on Leased Public Land Assessment Application 77-1374

|

| Mar 01 |

ASSR notifies governmental subdivisions of intent to tax property not used for public purpose

and not paying an in lieu tax. 77-202.12

|

| Mar 01 |

PTA submits report of active TIF to the legislature see Research Reports on web site. 18-2117.01

|

| Mar 16 |

Deadline for written request for

Extension of Time from PTA to file the County

Abstract of Assessment

for Real Property (Form 45) and the AVU

Directive 09-1 & 77-1514

|

| Mar 19 |

Must inspect-review portion of real property parcels in county so that all real property parcels are

inspected-reviewed no less than every 6 years. March 19, 2014 completes first 6-Year cycle 77-1311.03

|

| Mar 19 |

Complete the County Abstract of Assessment for Real Property (Form 45) with the PTA (and the Assessed Value Update (AVU)) 77-1301

|

| Mar 19 |

Certify the County Abstract of Assessment for Real Property (Form 45) with the PTA (and the Assessed Value Update (AVU)) 77-1514

|

| Aft Mar 19 |

Overvaluation or Undervaluation. After March 19 and before July 25 (Aug 10 when extension) report to B.O.E. any overvalued or undervalued property. 77-1315.01

|

| Anytime |

Duty to report to BOE all real property omitted from the assessment roll for the current or any former year except when such real property has changed ownership otherwise than by will,

inheritance, or gift. 77-1317, 77-123, 77-124,

|

| Anytime |

Correct the tax rolls as provided in section 77-1613.02 for any real property listed on the Assessment roll but omitted from the tax

roll. 77-1316.01

|

| Anytime |

BOE may meet at any time for correction of clerical errors defined in 77-128. 77-1507 (Clerical error means transposition of numbers, mathematical error, computer malfunction causing programming and printing errors, data entry error, items of real property other than

land identified on the wrong parcel, incorrect ownership, or certification of an incorrect valuation

to political subdivisions.) 77-128

|

| Mar 25 |

Assessorr may submit written comments to P.T.A. that become part of R & O REG 17-003.04

|

| Apr 01 |

If homestead exemption notices mailed on or before Feb 01 did not contain all of The statutorily required information a 2nd notice must be sent on/before April 01. 77-3513, 77-3514

|

Apr 01

|

If homestead exemption notices mailed on or before February 1 did not contain all of The statutorily required information, a 2nd notice must be sent on or before April 1 77-3513 77-3514

|

Apr 01

|

Last day to send a RE-APPLY reminder to eligible previous year homestead Exemption

applicants. 77-3513, 77-3514

|

| May 01 |

First-1/2 Real & Personal Property Taxes for Prior Year become delinquent 77-204

|

| May 01 |

Deadline File Ne Personal Property Return & Schedule w/o penalty. 77-1229

|

| May 01 |

Deadline w Agreement, File Form 775P &/or Form 312P Claim for P P Exemption & supporting schedules 77-4105 (2)(c ) & 77-5725 (7)(c)

|

May 01

|

First ½ of real & personal property taxes for prior assessment year become delinquent If unpaid in counties with less than 100,000 population. 77-204

|

| May 01 |

Deadline Physician’s Certificate for LATE

Homestead Exemption filing FORM 458L In counties less than 100,000 population. 77-3512, 77-3513, 77-3514.01

|

| May 15 |

Last Day for T.E.R.C. to adjust the valuation

of a class/sub-class of real property. 77-5028

|

| May 30 |

Deadline TREA & ASSR file FORM 458X

amended homestead exemption summary Certificate for tax loss previous year (NOTE: 458X may be filed reflecting changes based on income ANYTIME up to 3 years after the exemption year.) 77-3523 and 77-3517

|

| May 31 |

School system of County Official may request

corrections to school adjusted valuation due to tax list corrections of the prior assessment year. 79-1016

|

| Jun 01 |

Assr publishes a notice in the newspaper CERTIFYING the (a) assessment roll is Complete, (b) notices of valuation changes have been mailed, and (c) stating the final date for filing protests with the B O E 77-1315

|

| Jun 01 |

Freeholder files petition with local board (Assessor, Treasurer & Clerk) to have school districts changed which is contiguous to that land. 79-458(1)

|

| Jun 1 - Jul25 |

B O E holds hearings to review property valuation PROTESTS 77-1502

|

| Jun 5

|

If T.E.R.C. ordered changes, Assessor re-Certifies the Abstract with PTA 77-5029

|

| Jun 6 |

Assr mails assessment sales ratio stats given

by TERC to media & posts in office. 77-1315

|

| Jun 15 |

Assr prepares a PLAN OF ASSESSMENT report for the next 3 years. 77-1311.02

|

| Jun 30 |

Deadline for filing Homestead Exemption App

or Certification Of Status, Form 458 77-3512

|

Jun 30

|

Deadline Late Application and Written Request B O E for Waiver of Late Filing for permissive

exemptions Forms 451 or 451A 77-202.01

|

| Jun 30 |

Deadline. SPECIAL VALUATION application Ag-Hort use. Form 456 77-1345

|

Jun 30

|

Deadline file property valuation protest with

County Clerk (for BOE) 77-1502

|

Jun 30

|

Deadline P P Valuation Protest Returns filed

Jan 1 thru May 1 with County Clerk 77-1502

|

Jun 30

|

Deadline. SPECIAL VALUATION application Ag-Hort use. Form 456 77-1345

|

| Jun 30 |

Last day to add Personal Property value with a 10% Penalty 77-1233.04

|

| Jul 01 |

Added Personal Property is subject to 25%

Penalty from this date forward. 77-1233.04

|

| Jul 15 |

ASSR approves-denies SPECIAL VALUATION apps; notifies applicant before July 22 77-1345.01

|

| Jul 20 |

If deadline extension granted by B O E, new

Deadline for filing Homestead Exemption App or Certification Of Status, Form 458 77-3512

|

| Jul 20 |

County Assr electronically certifies the County Personal Property Abstract Report to the P.T.A. (beginning 2016) (LB 259) 77-1514

|

| Jul 22 |

Assr notifies applicants of special

valuation of approval or disapproval 77-1345.01

|

Jul 22

|

BOE sends notice of value change on Special Valued land if no notice previously Sent by Assr prior to June 1.

|

| Jul 26 |

BOE petition T.E.R.C. for an adjustment to the valuation of a class/sub-class of property. (NOTE: If protest period extended, BOE waives right to petition.) 77-1504.01; 77-1502

|

| Jul26-Aug24

|

Taxpayer file appeal of BOE to T.E.R.C. 77-1510

(NOTE: may file appeal to T.E.R.C. on/before Sep 10 for extended counties)

|

| Jul 31 |

Last day ASSR send Notice of Rejection of Homestead Exemption Form 458R 77-3516

|

Jul 31

|

Assr files 3-Year Plan Of Assessment with the BOE 77-1311.02

|

Jul 31

|

Last day for Annexations Pol Subs for taxable value in current year. 13-509(NOTE: Annexation by

Pol Subs on/after Aug 1 considered next year

taxable)

|

| Aug 01 |

Last day FORWARD approved Homestead Exemption Application or Certification of Status, Form 458, with Disability Certifications, Form 458B, or Veterans Affairs Letters, and Form 458 Schedule I – Income Statements to Tax Commissioner. 77-3517

|

Aug 01

|

Assr reviews ownership & use of all cemetery real property and reports to BOE. 77-202.10

|

Aug 01

|

Last Day Pol Sub submit request for LEVY ALLOCATION to BOE or CITY. 77-3443

|

Aug 01

|

CITY or Community Redevelopment Authority (CRA) files NOTICE to Divide Tax For Comm Redevel Project (T I F) with the County Assr. 18-2147(3)

|

| Aug 01 |

PTA certifies to T.E.R.C. the ASSR implemented the equalization orders. 77-5029

|

| Aug 01 |

Tax Commissioner certifies Exempt P P for Employment & Investment Growth Act Form

775P and Nebraska Advantage Act Form

312P ; notifies Taxpayer and County Assessor. 77-4105; 77-5725(c)

|

| Aug 02 |

County Clerk mails notice of B O E decisions

to protestors. 77-1502(4)

|

| Aug 10 |

Last Day T.E.R.C. act on BOE petition.. 77-1504.01

|

| Aug 10 |

T.E.R.C. sets equalization rate for real property of Centrally Assessed Railroads and Public Service

Entities. 77-5022

|

| Aug 10 |

PTA certifies distributed taxable value of Centrally Assessed Property to Assessor. 77-5030

|

| Aug 15

|

Approved Freeholder Petition filed on/before June 1 of current year become Effective. 79-458(3)

|

Aug 15

|

ASSR approves/denies Homestead Exemption based on Ownership or Occupancy From Jan 1 through Aug 15 77-3502

|

Aug 15

|

Deadline for Homestead Exemption to file an Application for Transfer Form 458T 77-3509.01

|

| Aug 20

|

Certify taxable valuations & growth value to political subs. Certify current values For each T I F project to City or Community Redevelopment Authority (CRA) and to Treasurer 13-509; 13-518; 18-2148

|

| Aug 20

|

If T.E.R.C. orders changes for B O E petitions, ASSR re-certifies ABSTRACT (Form 45) to PTA 77-1504.01

|

| Aug 24

|

Last day taxpayer appeals B O E decision to T.E.R.C. 77-1510

|

| Aug 25 |

ASSR certifies School District Taxable Value Report to P.T.A.. 79-1016

|

| Aug 31

|

Annual Inventory County Personal Property in custody of Assessor 23-347

|

Sep 01

|

Second-1/2 Real & Personal Property Taxes for Prior Year become delinquent 77-204

|

Sep 01

|

After B O E value adjustments, Assr determines AVERAGE RESIDENTAL VALUE For homestead exemption and certifies the Homestead Exemption Certification of Average Assessed Value of Single-Family Residential Property Form 458V to PTA 77-3506.02

|

Sep 01

|

No LEVY allocation change after this date except by agreement by LEVYING Authority and Political

Subdivision. 77-3443

|

| Sep 10 |

Where B O E extended Protest Hearings, Last day Protestor appeal BOE decision to T.E.R.C 77-1510

|

| Sep 15 |

B O E last day for decision on Under or Over Valued Property 77-1504

|

| Sep 15 |

P.T.A. certifies the amount of Real Property TAX CREDIT to State Treasurer and to each county. 77-4212

|

| Sep 20 |

BUDGETS must be Final and Filed with the levying board and State Auditor. 13-508

|

| Sep 30 |

ASSR may amend the School District Taxable Value Report for corrections or errors 79-1016

|

| Sep 30 |

BOE publishes list of Permissive Exemptions and sends list and proof of publication To P.T.A. 77-202.03 (5)

|

| Oct 1 |

Rent-Restricted Housing Projects file INCOME &

EXPENSE STATEMENTSs and any Other Info requested by Assr with both Assr & Tax Commissioner. (LB 356). 77-1333

|

| Oct 1 |

Rent-Restricted Housing Projects file INCOME &

EXPENSE STATEMENTS and any Other Info requested by Assr with both Assr & Tax Commissioner. (LB 356). 77-1333

|

| Oct 9 |

Last Day for voter approval to exceed LEVY limits or final allocation at election or “town hall meeting.” 77-3444

|

| Oct 10 |

P.T.A. certifies the school adjusted valuations to

Dept of Ed, School systems, and County Assessors. 79-1016

|

| Oct 10 |

P.T.A.certifies the school adjusted valuations to

Dept of Ed, School systems, and County Assessors. 79-1016

|

| Oct 13 |

Political Subs forward resolution setting a tax request different from the prior year to County Clerk 77-1601.02

|

| Oct 15 |

LEVY DATE Last day

B O E to set tax rates/levies 77-1601

|

| Oct 15 |

Last Day taxpayer file B O E appeal to T.E.R.C. re under or over valued property 77-1504

|

| Oct 31 |

Assr submits 3-Year Plan and any Amendments to Dept of Revenue 77-1311.02

|

| Nov |

Rent-Restricted Hsg Projects Valuation Committee meets annually in November to Examine Rent-Restricted Hsg Projects statements & expense reports in order to Calculate a Market-derived Capitalization Rate. (LB 356) 77-1333

|

| Nov 1 |

Last Day Tax Comm certifies qualified Homestead Exemption income determinations to the County

Assessor. 77-3517

|

| Nov 5 |

Last Day B O E correct levies/tax rates as a result

of clerical error. 77-1601

|

| Nov 10 |

Deadline school sys file appeal with Tax Comm

for the School Adjusted Value Certified for use in the school aid formula. 79-1016

|

Nov 10

|

School Dis or County Off deadline file written

request w Tax Comm correction school adjust

value due to clerical error or SPECIAL

VALUATION ADDITIONS 79-1016 |

| Nov 15

|

Deadline. EXEMPT TO EXEMPT. For an org to file a permissive exempt application For property it purchased between July 1 and levy date previously exempt. 77-202.03

|

| Nov 22 |

Deliver Signed WARRANT For Collection Of Taxes To Treasurer having completed the tax list for real and personal property. 77-1616

|

| Nov 30 |

Deadline ASSR & TREA certify to P.T.A. Homestead Exemption Summary Certificate Form

458S for tax loss due to homestead exemptions for the current tax year.(Both signatures required) 77-3523

|

| Nov 30 |

Deadline for ASSR & TREA certify electronically the Personal Property Tax Loss Summary Certificate for personal property exemption for locally assessed property(beginning 2016) (LB 259) 77-1239

|

| Dec 01 |

Assr files Certificate of Taxes Levied (CTL)

with P.T.A. 77-1613.01

|

| Dec 01 |

City or CRA (Community Redevelopment Authority) files report with P.T.A. for approved tax

increment financing projects (T I F) 18-2117.01

|

| Dec 01 |

Last day Property Tax Administrator (P.T.A.)

forwards copy of Rent-Restricted Housing Projects annual report by the Valuation Committee to ASSR for Cap Rate In determining value of rent-restricted

housing projects. (LB 356) 77-1333

|

| Dec 01 |

Deadline for ASSR to ensure sales data in state sales file is accurate and all sales Are included. Directive 12-05 |

| Dec 31 |

Real Property & Personal Property Taxes Due – LIEN DATE 77-203

|

| Dec 31 |

Permissive Exemption Application deadline For newly acquired property or in years divisible by four, file Exemption Application Form 451

For interim years, file Exemption Application Form 451A

For example: File Form 451A by Dec 31, 2014 to

reaffirm for assesssmt year 2015 File Form 451 by Dec 31, 2015 to apply for assessmt year 2016 (which is divisible by 4) 77-202.01; 77-202.03

|

| Dec 31 |

Deadline. Form 1027 Exemption App Qual Beginning Farmer / Livestock Producer Must be filed with Assr on-before Dec 31 in the year preceeding year applied for.Exemption is for

Personal Property tax on ag-hort machinery & equipment. 77-202.01; 77-5208; 77-5209.02

|

Dec 31

|

Deadline for taxpayer/owner to file Vacant or

Unimproved Lot Application, Form 191To elect to have 2 or more lots held for sale/resale to be treated as one parcel for Property tax purposes. 77-132

|

Dec 31

|

Owner petition T.E.R.C. determine taxable status of real property – if a failure to give proper notice prevented the timely filing of a protest or appeal for exempt property.

|

Dec 31

|

Last Day for Tax Commissioner to review income and other information for the third Preceding year and take any action. 77-3517

|

| May 01 & Sept 01 |

First 1 / 2 and 2nd 1 / 2, Real and Personal Property Taxes for prior assessment year Sept 01 become delinquent, if unpaid, in counties with a population less than 100,000 pop’n. 77-204

|

Permissive Exemptions

Property owned by religious, educational, charitable and cemetery organizations (or organizations organized and operated exclusively for the benefit of religious, educational, charitable and cemetery organizations, may obtain an exemption from property taxes in Nebraska, in whole or in part. There is a five-part test that must be met for the property to qualify. The test is:

- The property must be owned by a religious, educational, charitable or cemetery organization;

- The property must be used exclusively for religious, educational, charitable or cemetery purposes;

- The property may not be used for gain or profit for the owner or the user;

- The property may not be used for the sale of alcoholic liquor for more than 20 hours a week; and

- The property may not be owned or used by an organization which discriminates in membership or employment based on race, color, or national origin.

All five parts of the test must be met for property to qualify for tax exemption in Nebraska. An organization simply holding a tax exempt certificate from the Internal Revenue Service does not qualify property owned by the organization in Nebraska for a property tax exemption.

Permissive exemptions require an annual application with the County Assessor. In the first year for which an exemption is sought and subsequent years divisible by four, the organization seeking the exemption must file a Form 451. In the years in which the Form 451 is not required, the organization must file a Form 451A with the Assessor’s Office. Regardless of which form is required, the applications must be filed with the Assessor’s Office on or before December 31 of the year prior to the year for which the exemption is sought.

For additional questions or concerns, please contact our office:

Phone: (308)236-1210

Email: assessor@buffalocounty.ne.gov

Real Property Change of Address

The Assessor’s office cannot change an address on real property without the permission and authority from the owner of the record. If you desire to have your address changed, please fill out the Change of Address Form and send it to:

Buffalo County Assessor

PO Box 1270

Kearney, NE 68848-1270

Juvenile Justice System Guide

“The only real mistake is the one from which we learn nothing.”

--John Powell

REASONS FOR BEING IN COURT

Delinquent: charged with breaking a law of a State or City Ordinance.

Status Offender: Charged with being beyond control of his/her parent(s) or habitually truant. Examples include not going to school, not keeping a curfew, running away from home, not obeying parent rules, and using drugs, alcohol or tobacco under age.

WHAT THE COURT MAY DO

Delinquent: May be placed on probation under the supervision of a Probation Officer at home or in a group home or other restricted program. The Court may alternatively place a delinquent in the custody of the State Office of Juvenile Services (OJS) / Health and Human Services (HHS) where he/she may be supervised at home, in another placement in the community (such as foster care, group home, or residential treatment), or at the Youth Rehabilitation Treatment Center (YRTC) in Geneva or Kearney.

Commitment to Office of Juvenile Services / Health and Human Services (HHS): HHS provides Court-ordered services to youth including those of the Office of Juvenile Services, the Youth Rehabilitation Treatment Centers, and Out of Home Placement.

Status Offender: Special supervision may be required. Offender may be placed at home on Probation or made a State Ward through the Department of Health and Human Services for out-of-home placement or services in the home.

YOUR RIGHTS

You have a right to:

- Know what has been filed against you;

- An attorney (a Public Defender may be provided at no cost);

- Face and cross-examine witnesses;

- Present evidence in your own defense;

- Testify if you wish; however, you do not have to testify;

- Be advised by the Judge as to what the Court can do with you; and

- Appeal the Court’s decision to the Nebraska Court of Appeals or Nebraska Supreme Court.

ADVICE FOR COURTROOM BEHAVIOR

DO…

- Dress neatly and cleanly, as you would for an important meeting.

- Be 15 minutes early, so you are ready to attend the hearing on time.

- Speak loudly and clearly.

- Be honest and make eye contact when talking.

- Respond to Judge’s questions by saying, “Yes, Your Honor,” or “No, Your Honor.”

DO NOT…

- Curse, swear or lie;

- Get angry or roll your eyes;

- Walk out of the courtroom (you could be held in contempt;

- Speak or act rudely;

- Take a cell phone into the courtroom;

- Slouch or chew gum; or

- Wear sagging pants, offensive T-shirts or gang-related items.

DETENTION

Confinement in a locked facility for a period of time until your case is tried or a more suitable placement is found.

STAFF-INTENSIVE PLACEMENT

Unlocked staff-intensive placement for a period of time until your case is tried or a more suitable placement is found.

YOU MAY BE PLACED AT A DETENTION OR STAFF-SECURITY FACILITY IF YOU…

- ...fail to follow court orders (any law violation, including Court orders to obey your parents’ rules and curfew, and/or attend school).

- ...are a runaway youth (a history of running from home or if you run from your Court-ordered placement, such as foster or group home).

- …are a danger to yourself or others (violent, aggressive, gang-related behavior or use of alcohol or drugs).

- ...are being discharged unsatisfactorily from a placement facility. If you are not following rules of your Court-ordered placement and are discharged, you may be detained.

- ...an OJS evaluation is ordered to be done residentially.

An evaluation can be ordered by the judge to be completed while you are detained.

WHEN A YOUTH IN CHARGED WITH A CRIME:

| Step |

Description |

| 1. Arrest |

Upon arrest by Law Enforcement, the Officer may: 1) Street-

release, 2) Cite and release to a parent, or 3) Arrest and get authorization to detain.

|

| 2. Detention Decision |

If recommended by Law Enforcement, a Probation Officer assesses for detention or release to parent. If detained, the Deputy County Attorney reviews all information files the appropriate Petition and requests a hearing, which should be held in a timely manner. The Court reviews all facts and determines if further detention is needed. A Petition generally must be filed within 48 hours of detention, excluding weekends and holidays. If the youth is not detained, a report is forwarded to the County Attorney for a filing decision.

|

| 3. Filing |

A petition is filed in the court, or declined. The matter might be diverted without filing a Petition. The County Attorney may decide to charge the youth in Adult Court. If charged with a felony or misdemeanor, the youth could be detained.

|

| 4. Arraignment |

Prior to the hearing, the youth meets with his/her attorney to discuss charges and how to proceed. Through the attorney, a plea of admission, denial, or no contest is entered. If the youth denies the charge(s), the Court will schedule an Adjudication Hearing. If youth admits to the charge(s), the Court will schedule a Disposition Hearing and may order evaluations.

|

| 5. Adjudication |

This is the trial of the Petition, where the State must prove up on the charge(s). If Court finds the Petition to be true, Court acquires jurisdiction of the youth and the matter is then set for disposition. If the Petition is not found to be true, the case is dismissed.

|

| 6. Predisposition Investigation |

The Court may order a predisposition investigation (PDI) by a Probation Officer prior to the disposition hearing, which involves Collecting information from the youth, his/her family, the schools, previous mental health providers, and others. This is so the Judge can make an informed decision about how best to hold the offender accountable and address his or her specific needs. More evaluations may be required (such as chemical dependency or mental health). In abuse-neglect cases, the PDI and other evaluations are done by the Office of Juvenile Services (OJS).

|

| 7. Disposition Hearing |

Based on the PDI and other case information, the Court orders a plan to ensure accountability and rehabilitation. The plan could include out-of-home placement, further evaluation, treatment, probation, intensive supervision, or other services.

|

FREQUENTLY ASKED QUESTIONS

What is Juvenile Court?

Nebraska laws have separate guidelines for juveniles (as opposed to adults, age 18 and over) who have violated the law or have other behaviors in need of intervention. Juvenile Court involvement is not considered to be a criminal record, but is intended to provide the juvenile an opportunity for rehabilitation.

What is a petition?

A petition is a legal paper, filed in the Court, outlining why you are being brought to court.

How will I know when to go to court?

You will receive a summons or letter giving the date, time, and location. The number of times you attend depends on individual circumstances. Inform the Court and Probation Officer of address or telephone changes.

What if I miss a hearing?

The judge could order you to be picked up by law enforcement, detained, and brought before the Court to explain why you ignored the Court’s notice.

What if I do not follow the Court’s rules?

A motion to review or revoke your placement or probation may be filed by the County Attorney, asking the Court to place more severe requirements on your probation or place you in an institution or state juvenile correctional facility.

Can my record be sealed (kept confidential)?

You may ask the Court to seal your records. This sets aside the record and it cannot be opened without Court approval and good cause. However, even if sealed, certain persons or agencies may still be able to access your records.

What if I waive the right to an attorney?

If you do so, you would be representing yourself. If you do not have an understanding or knowledge of legal options and process (such as motions to make, how to call and examine witnesses, and how to request services from the Court), you may be adversely affected. Remember, you can request an attorney to represent you at any point in the process.

| Office |

Phone Number |

| Attention Center |

(308) 236-1922 |

| County Attorney’s Office |

236-1222 |

| County Court |

236-1228 |

| City of Kearney Attorney’s Office |

237-3155 |

| Crisis Assistance Center |

(800) 325-1111 |

| Detention Center |

(308) 233-5281 |

| District Court |

236-1246 |

Health & Human Services (HHS)

• Geneva/Kearney

• Office of Juvenile Services (OJS)

• Out-of-home Placements

• Youth Rehabilitation and Treatment Centers

|

865-5592 |

| Juvenile Diversion |

236-1922 |

| Truancy/Juvenile Diversion |

236-1920 |

| State Probation |

236-1251 |

| Buffalo County Sheriff |

236-8555 |

Kearney Police Department

• non-emergency

• EMERGENCY

|

237-2104

911 |

| Family Resource Council |

237-4472 |

| Nebraska Workforce Development |

865-5404 |

Region III

• Early Intensive Care Coordination

• Professional Partner Program

|

237-5113

Ext. 238

Ext. 238 |

| Buffalo County Community Health Partners |

865-2284 |

Each individual is entitled to be, and is capable of being, responsible for his or her lawful participation in society.

Revised from the Crime Commission brochure “A Guide to Juvenile Court for Parents & Children.”

A printer-friendly version of this page is available.

Drug Court

Purpose:

The Central Nebraska Drug Court seeks to improve public safety, and reduce substance abuse and crime by providing offenders with appropriate treatment, intensive supervision and comprehensive judicial monitoring.

The Drug Court serves Adams, Buffalo, Hall, and Phelps Counties in Nebraska. It is administered by the District Courts of the Ninth and Tenth Judicial Districts.

What is the Central Nebraska Drug Court?

The Drug Court is a voluntary program created by the District Court that allows eligible defendants to earn a dismissal of charges in exchange for completing substance abuse treatment and other conditions.

Individuals eligible for the Drug Court will earn a dismissal of pending felony charges upon completion of the Drug Court program, a minimum of eighteen months in length.

The County Attorney must approve all requests for the Drug Court.

What are the Drug Court Requirements?

Each person’s requirements and conditions may be different depending on individual circumstances. However, the general requirements for everyone include:

- Complete a comprehensive assessment with the Drug Court staff

- Complete the substance abuse treatment recommended by the Drug Court staff

- Attend regular appearances before the Drug Court Judge

- Submit to regular drug testing

- Pay a weekly program fee to the Drug Court

- Pay part of the costs of treatment, based on ability to pay

- Reside in a participating county while in the program

- Maintain employment, attend school, or complete other conditions as directed by the Court or staff

- Meet with the Drug Court staff

- Pay any court costs due

- Obey all laws

Who is eligible for the Drug Court?

Certain offenses will qualify for Drug Court, some will not. Generally, there must be no more than one prior felony conviction. The County Attorney must approve all applicants.

Also, the participant must acknowledge having a substance abuse problem and agree to complete drug and/or alcohol treatment. Applications for Drug Court must be made within thirty days after arraignment in District Court. The Judge must approve all petitions for admission to the Drug Court.

Who is NOT eligible for the Drug Court?

- If charged with an ineligible offense, such as murder, manslaughter, robbery, felony assault, sexual assault, or assault with a deadly weapon

- Prior felony conviction for a crime of violence

- Prior or current offense involved the use or possession of a firearm or a dangerous weapon

- Prior or current offense resulted in death or serious bodily injury

- Current offense involved the use of force against a person

- Two or more felony convictions

- Multiple prior misdemeanors for crimes against a person, such as assault, domestic violence, resisting arrest, assaulting a law enforcement officer, or flight to avoid arrest

How to apply for the Drug Court

If you meet the eligibility criteria and want to apply for the Drug Court, consult with your attorney immediately.

General questions can be directed to:

Susan Huber

Problem Solving Court Coordinator

610 Central Avenue

Kearney, NE 68847

Telephone: (308) 236-1240

Traffic

Purpose:

The Traffic Division of the Buffalo County Attorney’s Office prosecutes all violations of the Nebraska Rules of the Road, including driving under the influence and speeding, game and parks violations, and more.

Additionally, the Division enforces selected provisions of the Kearney City Code that pertain to traffic and advises law enforcement on traffic issues.

Find information on Nebraska’s Point System for drivers licenses.

Do you have a Buffalo County traffic citation? You have these options:

- Contest the citation. Personally appear in the Buffalo County Court on the date and time given on your citation and invoke your right to trial. See the rights you have as an accused person.

- Pay the citation by waiver. Pay the fines and costs no later than your court date without appearing in court. This can be done online. Waiver fines are set by the Nebraska Supreme Court for those who wish simply to pay their ticket without going to court over it. For more information, view the Nebraska Supreme Court Waiver Fine List .

- Inquire about the STOP class. The Safety Training Option Program (STOP) class is offered by the Nebraska Safety Center to individuals who have been ticketed for committing a minor traffic violation. It takes four hours to complete. It is voluntary. By completing it, the violator pays no fine, has no court appearance, has no points assessed on their driving record, and can improve their driving skills.

The Nebraska Safety Center offers this program across the State. For more information or to register, call the Safety Center at (308) 865-1287 or register online at www.unk.edu/stop.

Classes are held the first Sunday of the month from 1:00 p.m. to 5:00 p.m.; the third Saturday of the month from 8:00 a.m. to 12:00 p.m.; and the fourth Monday of the month from 6:00 p.m. to 10:00 p.m. Holiday times may vary.

All classes are held at:University of Nebraska at Kearney

West Center

Room 012N

Kearney, NE 68849

(Map information)

YOU MUST REGISTER FOR STOP WITHIN FIVE BUSINESS DAYS OF THE OFFENSE, AND COMPLETE THE CLASS WITHIN 21 DAYS OF THE OFFENSE.

You are not eligible for the STOP class if your citation is for:

- Speeding twenty (20) or miles per hour over the speed limit.

- Leaving the scene of an accident.

- Driving under the influence of alcohol or drugs.

- Reckless driving or willful reckless driving.

- Participating in a speed contest, race, or exhibition of acceleration.

- Operating a motor vehicle to avoid arrest.

- Driving on a suspended or revoked operator’s license.

- Operating a motor vehicle without insurance or proof of financial responsibility.

- Any injury accident or violation which is classified as a misdemeanor or a felony.

Also, you are not eligible for the STOP class if:

- You hold a Commercial Driver’s License (CDL), even if you were cited while operating a non-commercial vehicle.

- You have participated in any STOP class within the last three (3) years.

- You wish to contest your citation.

Meeting these eligibility requirements is the responsibility of the participant.

HOW TO REGISTER:

- Call the Nebraska Safety Center at (308) 865-1287, or visit their website, www.unk.edu/stop, for more information.

- Download the registration form.

Civil Division

Purpose:

The Civil Division of the Buffalo County Attorney’s Office represents the County in actions brought on behalf of or against the County. The Division also represents and advises the Buffalo County Board of Commissioners and other elected and appointed officials, including the Planning and Zoning Commission.

The Civil Division is responsible for the final determination of County inheritance taxes due on estates administered in Buffalo County, for tax foreclosures for non-payment of real estate taxes, represents the County in general tax assessment and collection processes, county official’s involvement in garnishment and execution processes, and for Tort claims against the County.

Contact:

Buffalo County Attorney’s Office

Civil Division

(308) 236-1222

Juvenile Diversion

Purpose:

The Buffalo County Juvenile Diversion Program is committed to assisting youth in avoiding delinquent and criminal behavior. Juvenile rehabilitation and accountability is the primary goal of the program.

Eligibility:

Individuals who wish to participate in the Juvenile Diversion Program must:

- Be between 12 and 18 years of age. (Juveniles 11 and younger will be assessed on a case-by-case basis.)

- Accept responsibility for their offense and acknowledge the extent of their involvement.

- Be willing to comply with all of the program requirements.

- Reside in Buffalo County.

Prior criminal and juvenile court records will be considered in the eligibility determination. The program is voluntary, and is a privilege, not a right.

Seriousness of the Offense:

In determining the eligibility of the juvenile to participate in Diversion, the County Attorney will consider the seriousness of the offense. These factors will be used:

- The juvenile’s previous encounters with the law, including delinquent behavior.

- The length of time over which any prior offenses occurred, and similarity of those offenses.

- Whether the offense involved violence, and whether it was premeditated.

- The number of victims involved in the offense.

- The potential for actual harm to the victim(s), even if unintended.

- The monetary value of any damages.

- The juvenile’s motives for committing the offense.

- The likelihood of future law violations

- Whether the juvenile is amenable to treatment.

Advantages to Participation:

Successful Diversion participants benefit in these ways:

- Criminal charges regarding the offense will be dismissed or not filed.

- Improvement in personal responsibility and coping skills.

- Opportunity to develop a sense of community responsibility and accountability.

Requirements:

- Assessment. Upon the offer by the County Attorney to participate in Diversion, the juvenile will complete an intake assessment. He or she will be required to meet with the Diversion Administrator to discuss the referral, the diversion process, and the offender’s willingness to participate. The youth’s history, family life, academic performance, and other relevant factors will be examined. The Diversion Administrator may also provide avenues for additional services and/or make referrals to other agencies.

- Drug/Alcohol Assessment. All youth who are referred with drug- or alcohol-related offenses will be required to get a complete professional drug/alcohol evaluation at their expense. The results of this assessment will be shared with the youth and their parent(s), and be required to follow the recommendations of the assessment.

- Drug/Alcohol Testing. Once accepted into the Program, continued use or possession of illegal drugs or alcohol will be forbidden. At any time while on Diversion, the youth may be required to submit to drug and alcohol screening. The Diversion Administrator may share the results of such testing with the County Attorney, who will consider whether the youth will be allowed to continue in the Diversion Program. An offender deemed no longer eligible for Diversion will be referred back to the court for formal charges.

- Curfews. After being accepted into the Juvenile Diversion Program, some participants may be required to observe a curfew. The juvenile, the parent(s), and the Program Administrator will help in determining the curfew times and conditions.

- Duration of the Program. The Program will be tailored to the individual needs of the juvenile. Consequently, the duration of the program will depend on the offender. The maximum term of Diversion will not exceed one year.

- No Plea Required. While the participant must acknowledge their participation in the offense, they will not be required to enter a court plea of “admit” or “no contest.” The County Attorney will not use any admissions if charges are subsequently filed.

- Victim/Offender Mediation. If the victim agrees, the offender may be considered for mediation.

- Sponsor. A juvenile participating in Diversion will be asked to have a responsible adult as their sponsor. The Program Administrator must approve the sponsor. The sponsor may be a parent, relative, or friend.

Specific Requirements May Include:

- Paying all required fines, fees, and restitution.

- Satisfactorily completing all required community service.

- Attending and participating in all educational classes.

- Writing a letter of apology to the victim(s).

- Informing the school in writing about participation in the Diversion Program and serving all, if any, school-related consequences.

- Avoiding social situations that may involve criminal or delinquent behavior.

- Obeying school and household rules, and working towards a good academic standing.

- Receiving no additional violations and obeying the rules of the Program.

- Signing a release of information permitting open communication with the school and other interested parties and the Diversion Program.

- Each individual is entitled to and capable of being responsible for his or her lawful participation in society.

How to Apply:

If you are offered Diversion, please complete our Youth Questionnaire and Parent Questionnaire, then call the Diversion office at (308) 236-1922 for an appointment.

Truancy office phone number is (308) 236-1920

Safe Room Q & A

What is a safe room? What are the design requirements for a FEMA safe room?

A safe room is a hardened structure specifically designed to meet FEMA criteria and provide "near-absolute protection" in extreme weather events, including tornadoes and hurricanes. The level of protection provided by a safe room is a function of its design parameters, specifically the design wind speed and resulting wind pressure and the wind-borne debris load resistance. To be considered a FEMA safe room, the structure must be designed and constructed to the guidelines specified in FEMA P-320, Taking Shelter

from the Storm: Building a Safe Room for Your Home or Small Business (FEMA, third edition, 2008a) (for home and small business safe rooms). Additionally, all applicable Federal, State, and local codes must be followed. When questions arise pertaining to the differences between FEMA P320 criteria and another code or standard, the most conservative criteria should apply.

Should I have a safe room?

Pages 6 through 10 of FEMA P-320 (FEMA, 2008a) provide background information to help homeowners decide if a safe room is needed in their home. Homeowners and small-business owners should also refer to the Homeowner’s Worksheet, Assessing Your Risk (Table I-1) in FEMA P-320 (FEMA, 2008a); this is an easy-to-use matrix that helps users decide whether a safe room is a matter of preference, should be considered, or is the preferred method for protection from extreme winds.

My house has a basement. Do I need a safe room?

Some strong tornadoes have resulted in loss of floor framing, collapse of basement walls, and death and injuries to individuals taking refuge in a basement. What constitutes an acceptable level of protection is an individual decision. A basement may be the safest place to seek shelter for homes without a safe room, but it will not provide the same level of protection as a safe room unless it has been designed and constructed to provide the level of protection in accordance with FEMA P-320 (FEMA, 2008a) and FEMA P-361 (FEMA, 2008b).

A basement is a good location to install a shelter or build a safe room, but access for handicapped or physically challenged individuals may be limited. The flood risk of your location may also affect whether it is appropriate to place a safe room in your basement. If your house or neighborhood is prone to flooding, the basement may not be an appropriate location for taking refuge.

Where can I find information about obtaining FEMA funding to construct a safe room? Are there any funds available in my area?

For project eligibility and financial assistance questions, please contact your Local Emergency Manager. Your Emergency Manager can advise you on what information must be provided for your project to be considered for funding, as well as any applicable Federal, State, and local design requirements.

Can I still apply for FEMA funding after I have begun construction of a safe room or purchased a safe room?

No. You must apply for funding before the purchase of a safe room or beginning any construction. Section D.2, Part III of FY 2011 Hazard Mitigation Assistance Unified Guidance (FEMA, 2010) states that costs related to projects for which actual physical work (such as groundbreaking, demolition, or construction of a raised foundation) has occurred prior to award or final approval are ineligible.

What costs are eligible for funding under a safe room grant?

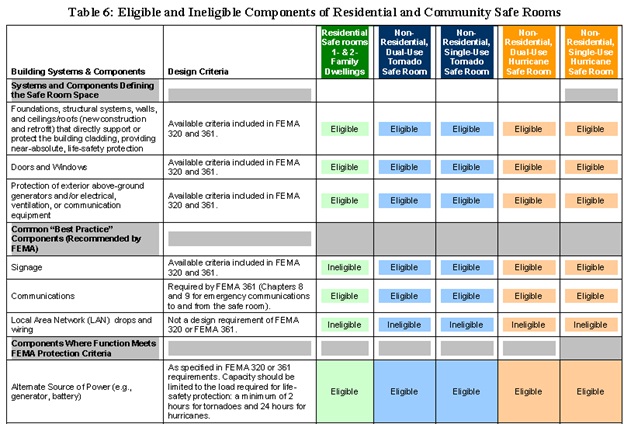

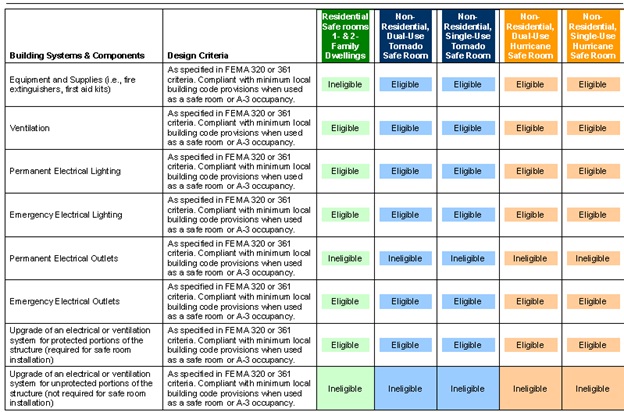

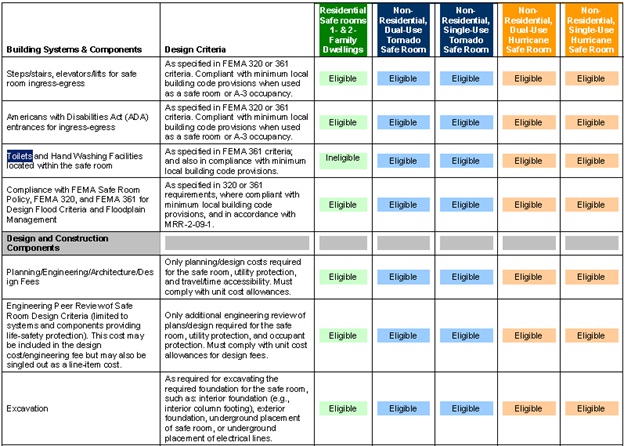

Allowable costs for safe room projects funded under FEMA’s Hazard Mitigation Grant Program (HMGP) are those components related to, and necessary for, providing life safety for building residents in the immediate vicinity during an extreme-wind event. The funding covers design and building costs related to structural and building envelope protection. The funding covers both retrofits to existing facilities and new construction projects, and applies to both single- and multi-use facilities.

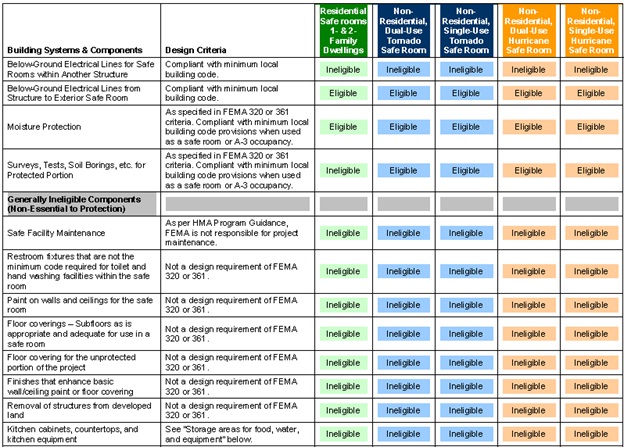

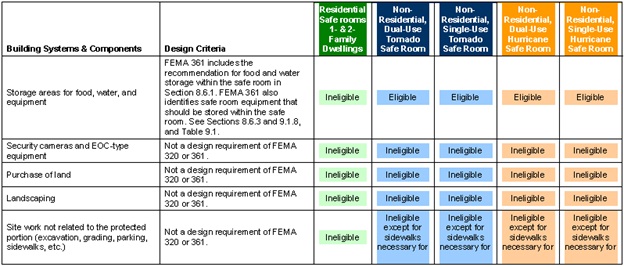

Eligible costs are only those consistent with FEMA-approved performance criteria as provided in FEMA P-320 (FEMA, 2008a). These criteria are summarized in Table 6 (below) of the 2011 FY FEMA Hazard Mitigation Assistance Unified Guidance (FEMA, 2010). (Click the table to view it larger.)

Does FEMA approve, endorse, or certify any products?

No. Federal No. Federal policy does not allow FEMA to approve, endorse, certify, or recommend any products. While a product may be in compliance with FEMA design guidance, any language from manufacturers stating their product is "FEMA approved" or "FEMA certified" is incorrect.

What is the recommended square footage per person for a residential tornado and hurricane safe room?

For residential safe rooms, the usable tornado safe room floor area should be the gross floor area minus the area of sanitary facilities, if any, and should include the protected occupant area between the safe room walls at the height of any fixed seating, if it exists. The minimum recommended safe room floor area per occupant for residential tornado and hurricane safe rooms is provided in table below. (Click the table to view it larger.)

What is the cost of installing a safe room in a new home or small business?

Costs for construction vary across the United States. The cost for constructing a safe room that can double as a master closet, bathroom, or utility room inside a new home or small business ranges from approximately $6,600 to $8,700 (in 2011 dollars). This cost range is applicable to the basic designs in FEMA P-320 (FEMA, 2008a) for an 8-foot by 8-foot safe room (approximately 64 square feet of protected space). Larger, more refined designs for greater comfort cost more, with 14 foot by 14-foot safe rooms ranging in cost from approximately $12,000 to $14,300. The cost of the safe room can vary significantly, depending on the following factors:

- The size of the safe room

- The location of the safe room within the home or small business

- The number of exterior home walls used in the construction of the safe room

- The type of door used

- The type of foundation on which the safe room is constructed

- The location of the home or small business within the United States

For additional cost information for small safe rooms in a home or small business, see FEMA P-320 (FEMA, 2008a), Section II, page 34.

As a homeowner, can I build the safe room on my own?

A homeowner who builds a safe room should be skilled in building construction. Some pre-fabricated safe rooms are available that require less building construction experience to successfully install. In purchasing any safe room, the homeowner should obtain sufficient documentation to determine that the safe room is built to the FEMA safe room design and protection criteria.

Can I install a safe room in an existing home?

Yes, though installing a safe room in an existing home or small business is typically more expensive and challenging than installing one in a new building. Modifying the walls or foundation of an existing building for the construction of a safe room is more complicated than constructing those elements new and, as a result, some of the prescriptive safe room designs provided in FEMA P-320 (FEMA, 2008a) are not practical for some existing homes. Typically, installing a safe room in an existing home costs 20 percent more than installing the same safe room in a new home under construction.

Due to the technical challenges involved in retrofitting an existing home for a safe room,

an architect or engineer should be consulted to address the structural issues and the wind-borne debris protection criteria, even when not required by the local building department. As such, homeowners must balance the desire to have protection within their home with the practicality of constructing a safe room outside the footprint of their existing home or structure for less money. For more information on retrofitting existing buildings with a safe room, see FEMA P-320 (FEMA, 2008a), Section II, page 25.

Is an underground safe room safer than one above ground?

As long as a safe room is designed to meet or exceed the criteria in FEMA P-320 (FEMA, 2008a) and FEMA P-361 (FEMA, 2008b), it will offer the same near-absolute protection whether it is above or below ground.

Where is the best location for the safe room?

There are several possible locations in or near your home or small business for a safe room. The most convenient location in many homes is in the basement. If there is no basement within the home, or if the walls of the basement do not meet FEMA P-320 (FEMA, 2008a) design criteria, an in-ground safe room can be installed beneath a concrete slab-on-grade foundation or concrete garage floor. In-ground and basement safe rooms provide the highest level of protection against missiles and falling debris because they are typically shielded from direct forces of wind and debris; however,

above-ground designs, such as the prescriptive designs provided in FEMA P-320 (FEMA, 2008a) or any solution following the criteria set forth in FEMA P-361 (FEMA, 2008b) will provide near-absolute protection.

Many individuals prefer to build within their homes or buildings so they have some level of

protection while attempting to access their safe room. For an existing home or small business, this convenience must be balanced with the challenges of retrofitting the building. For more information on selecting the location of a safe room within your home or small business, see FEMA P-320 (2008a), Section II, page 27.

Are inspections required?

Obtaining proper building permits and inspections is important for all construction. The builder or homeowner should ensure the safe room is built according to the plans in FEMA P-320 (FEMA, 2008a) or to plans that, through testing and engineering, have been determined to meet the safe room design criteria in FEMA P-320 (FEMA, 2008a) or FEMA P-361 (FEMA, 2008b). The level of construction needed for a safe room typically requires a permit from the local building department. Further, to verify compliance with the FEMA or International Code Council (ICC)-500 (ICC, 2008) criteria, additional quality control inspections for community safe rooms, and often for residential safe rooms, may be needed.

If the Storm shelter costs $6,000.00 can I get more than $2,000 reimbursed?

No, the Hazard Mitigation Program only allows reimbursements up to 75% of the approved costs.

I need to have my Storm Shelter money up front to pay my contractor. Is this possible?

No, The money is only available as a reimbursement, AFTER construction is completed and you have submitted signed and notarized documentation from your contractor stating your Storm Shelter meets or exceeds the specification set forth in FEMA Publication 320.

If I am eligible to receive the $2,000 rebate, do I have to consider that money as income for State and Federal Income Tax purposes?

No, in accordance with the Robert T. Stafford Disaster Relief and Emergency Assistance Act, as amended, these funds are considered free from tax liability under Federally funded assistance programs.

Geographic Information System

Click the button below to access GIS:

Our GIS site is open to the public with three offices currently online.

On the Assessor tab you will be able to view parcels and section information. A photo and sketch of each parcel are also available. If you have any questions about information on the Assessor tab, please call 308-236-1205.

On the Planning/Zoning tab you will be able to see information on floodplains, wellhead protection areas, and county zones. If you have any questions about information on the Planning/Zoning tab, please call 308-236-1998.

GIS Data For Download

You can now download some of our GIS layers below. The data is available in shapefile format only.

Centerline Data (Updated 2015-05-06)

Services

| Assessor |

| Valuation protest information |

| Homestead

exemptions |

| Mobile

home ownership transfer |

| Charitable, religious, and educational tax exemptions |

| |

| Attorney |

| Prosecute cases |

| Collect bad checks |

| Child Support |

| Inheritance tax review |

| |

| Board of Commisioners |

| Board of Commissioners minutes |

| Board of Commissioners agendas |

| Board of Commissioners notices |

| Property tax protests |

| |

| Clerk |

| Marriage

license information |

| Military discharge information |

| Proof

of publications |

| Corporations |

| Partnerships |

| County budget |

| County vendor claims |

| County payroll information |

| School census records |

| Minutes

of the Board of Commissioners meetings |

| Waste hauler permits |

| Tobacco licenses outside city limits |

| |

| District Court |

| Issue

writs and orders |

| Collect

and dispense fees for Child Support |

| Keep

records, books and papers pertaining to court |

| Record

proceedings of court |

| Issue passports |

| |

| Election |

| Voter information |

| Voter registration |

| Absentee voting |

| Absentee ballot |

| Polling places |

| Election calendar |

| Election results |

| Poll worker information |

| |

| Floodplain |

| Issue

floodplain permits for residences or structures |

| |

| Highway |

| County road information |

| County bridge information |

| |

| Public Defender |

| Court appoints to defend someone who can not hire their own

attorney |

| |

| Register of Deeds |

| Mortgages |

| Deeds

of trust |

| Plats |

| Old land records |

|

| Sheriff |

| Enforce laws |

| Preserve

the peace |

| Provide

a safe environment |

| Answer

911 calls and dispatch appropriate authority |

| |

| Surveyor |

| Establish

boundaries |

| Locate lots, plots, parcels, tracts, or division of land |

| Division

may include distance, direction, elevation and acreage |

| Furnish legal descriptions to be used in the platting or subdividing

of land |

| Determine

the amount of acreage in land surveyed |

| Establish

and reestablish corners |

| Topographical

plat |

| |

| Treasurer |

| Tax payment information |

| Drivers license |

| CDL's |

| Learner's permits |

| ID

cards |

| Motor vehicle licenses and registrations |

| Boat registrations |

| Specialty license plate applications |

| |

| Veteran Services |

| Veteran's benefits |

| Military discharge records |

| |

| Weed Control |

| Plant identification |

| Weed control issues |

| Enforcement

of state weed laws |

| |

| Zoning |

|

Approve and issue zoning permits

|

|

Receive applications for zoning variance permits

|

|

Receive applications for change of zoning permits

|

|

Receive applications for special use permits

|

|

Conduct inspections of setbacks and

uses of land

|

Political Party Information

Currently the political parties recognized under Nebraska

law are as follows:

The elected offices nominated on a partisan basis are:

President, Vice President, U. S. Senators, Member of the U. S. House of Representatives, Governor, Lt. Governor, Secretary of State, State Auditor, State Treasurer, State Attorney General, County Commissioners, County Clerk, County Attorney, Register of Deeds, County Assessor, Clerk of the District Court, County Sheriff, County Treasurer and County Surveyor.

Effective: December 2, 2013

County Benefits

The Buffalo County Veterans Service Office offers the following benefits for those veterans who are eligible:

County Veterans Aid Fund

The CVA fund is a temporary emergency fund to assist veterans, their spouses, and dependents when there is an unforeseen emergency and there are no other resources available. Eligible veterans are persons who served on active duty, received an Honorable Discharge, and served during one of the defined "wartime eras" and who have resided in Nebraska for at least one year, and Buffalo County for at least six months. Applicants may request assistance with food, shelter, clothing, funeral, medical, dental, and surgical items. The applicant must apply through the County Service Office in Buffalo County. This is an "aid" program so the veteran must demonstrate an "inability" to meet the obligation to pay these bills, via an application.

Bronze Grave Flag Holders

State of Nebraska statute requires the County Veterans Service Office to provide a flag holder reflecting the veterans wartime era. The Buffalo County, Veterans Service Office also annually inventories these flag holders to insure they remains on the correct grave and we replace damaged markers.

Registration of DD214s

Buffalo County records a "certified copy" of the original copy of a veterans military separation document (DD-214). Once recorded the veteran may call us from any where in the world and we will provide them with a "certified copy" when needed.

Homestead Exemption

Annually, the Buffalo County Veterans Service Office obtains a letter from the VA Regional Office that establishes who are eligible veterans (or widows) for a tax exemption on their personal residence. These letters are provided to the County Assessor.

Grave Registration

Upon notification of the burial of a veteran in Buffalo County we complete a "grave registration card". We maintain a copy here in Buffalo County, and the original is sent to the State of Nebraska, Department of Veteran's Affairs in Lincoln. We also order a "Presidential Memorial Certificate" for the family of all deceased Buffalo County veterans.

Disclaimer Statement

NOTICE

The information provided by this service resides on a computer system funded by the County of Buffalo, Nebraska. Anyone using this service consents to the monitoring of their use of this service by the computer system providers, authorized County of Buffalo, Nebraska employees, as well as security or law enforcement personnel. Communications made through this service's electronic mail and Messaging system shall, in no way be deemed to constitute a filing with or legal notice to the County of Buffalo or any of its agencies, departments, authorities, officers, directors, employees, agents or representatives, with respect to any existing or potential claim or cause of action against the County or any of its agencies, departments, authorities, officers, directors, employees, agents or representatives, where notice to the County is required by any federal, state or local law, rule or regulation.

Government Offices can only accept written documents for filing into official government records unless specific statutory language authorizes filings done by other than written medium.

PRIVACY POLICY

The protection of individual privacy is a concern to Buffalo County. Buffalo County has created this privacy statement in order to demonstrate its firm commitment to privacy. The following discloses our information gathering and dissemination practices for this site.

Information You Provide to Us:

Buffalo County does not keep any personal information about you or your visit to our Internet site unless you have specifically supplied it to us. If you may have supplied us with information as part of a request for information or to e-file an appeal of your Board of Property Assessment decision. This also applies to any feedback or on-line survey information you may have sent us through our website. In cases where you have supplied us with information, including financial data, we will treat such information in accordance with the requirements of the law. This means that it will be treated in the same way as written forms of communication, and in many instances it will be considered public information available to the public upon request. To the extent allowed by law, Buffalo County will make reasonable attempts to protect personal financial information from disclosure.

Public Disclosure:

As a general rule, Buffalo County does not disclose any personally identifiable information collected online except where you have given us permission or where the information is public information under the Nebraska Public Records Act et seq., or other applicable laws. Visitors should be aware that information collected by the County on its websites may be subject to examination and inspection if such information is a public record and not otherwise protected from disclosure.

Other Information about Your Visit to Our Site:

Our web site does not automatically collect any information from your computer during your visit. Certain pages, however, may tally total number of visitors.

This privacy policy does not apply to web sites operated by third parties that you may access through a link from our web site.

DISCLAIMER OF WARRANTIES